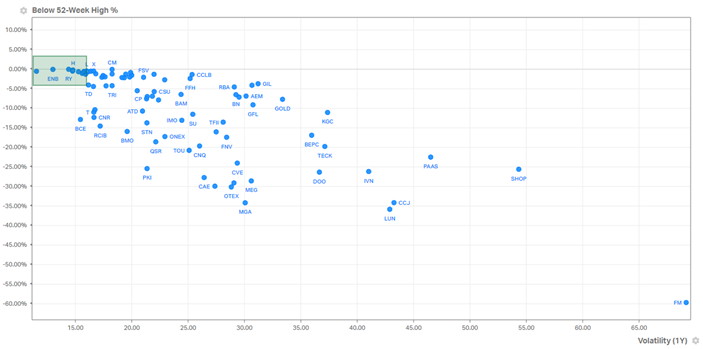

In this edition of ‘Stock Teasers’, we are going to be looking at Canadian stock outliers using a unique screener in each edition. The screeners have two main variables, of which will change each time, and the end goal is to find a group of stock outliers on the graph and identify why they might be outliers.

Low Volatility Stocks Near Their 52-Week Highs

We have used the following variables across the Canadian stock universe: percentage below 52-week highs and one-year volatility. Gauging whether a stock is near its 52-week high is important as it indicates both positive one-year momentum, and typically, a stock that is hitting new 52-week highs is doing something right. While it may seem intimidating for some investors to purchase a stock near its 52-week highs, we have found that purchasing near 52-week highs is often better than purchasing a stock that is well off of its highs. In an environment where the economy is showing some signs of slowing, there is uncertainty due to the path of rate cuts and other macro signs, we wanted to explore stocks that have exhibited low levels of volatility. The combination of the two factors shows us Canadian names (green shaded area) that have positive momentum (and are likely doing something right fundamentally) and are low volatility, which can help in times of uncertainty.

Looking at the green region, we briefly discuss a few of the companies below:

- Pembina Pipeline Corporation (PPL): PPL is a leading energy transportation and midstream service provider in North America, and it is up nearly 24% year-to-date, with a one-year volatility level of 11.6. This indicates subdued levels of volatility, particularly compared with some of the high-growth tech names in Canada.

- Enbridge (ENB): ENB is an energy infrastructure company, specializing as a natural gas utility provider and distributor. It has a strategic asset base, strong cash flows, and on a year-ot-date basis, it is up a total 21% with a volatility level of 13.

- Royal Bank of Canada (RY): RY is a leading diversified Canadian bank, providing personal and commercial banking, wealth management, insurance, investor services, and capital markets services. It has a strong industry position and is up a total 27% year-to-date, with a one-year volatility of 14.5.

- Hydro One (H): Hydro One is a major electricity provider and distributor in Ontario, providing electricity for homes and businesses. It is a solid income name, with a dividend yield of 2.7%, a year-to-date total return of 19% and a one-year volatility of 14.8.

- Sun Life Financial (SLF): SLF is a life insurance and investment management services company, with a large asset base and a robust financial position. It is up a total 12% year-to-date with a volatility level of 15.7.

Common Theme Among Canadian Stock Outliers

We hope that readers enjoyed this edition of ‘Stock Teasers’ talking about some of the Canadian stock outliers for stocks near their 52-week highs and with low levels of volatility. A common theme among the stocks we highlighted is most operated in highly regulated industries, either in the financial services or the energy or utility provider industries. These are also well-capitalized names, which have strong track records, with good management teams, and can benefit from a period of economic strength. For other editions of our ‘Stock Teasers’, check out our latest blog on This or That? Northland Power (NPI) or Boralex (BLX).

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Research for Today, Invest for Tomorrow.

Twitter: @5iChris

Comments

Login to post a comment.