Report Updates

We have posted report updates on Tricon Residential (TCN) and Savaria Corp. (SIS). Both companies' ratings have been maintained from previous reports. One company is focused on housing within the US Sun Belt states while the other is focused on accessibility equipment. Increased capital through joint ventures, accelerating trends due to the pandemic, good cash flow growth, and a recent promising acquisition. We think

both companies have a bright future and have done a lot of things right.

Read the latest updates by logging in here!

Market Update

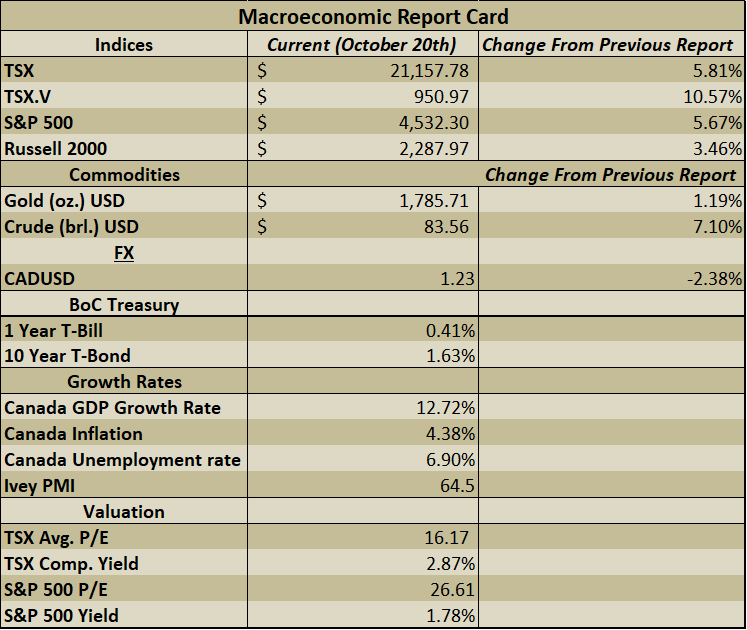

Markets have begun to bounce back after a red September and earnings season has officially kicked off. Companies have so far begun to top estimates and the US banks have reported positive results thus far. The price of oil continues to surge and has recently hit as high as $83. US initial jobless claims have fallen to their lowest levels since the onset of the pandemic and the Bank of Canada has noted that supply chain issues may persist longer than expected, and cause inflation to run even hotter. Below, we cover the current causes of the supply chain issues and how to use this information and invest going forward.

Global Supply Chain Backdrop

Supply chains are a complicated web of raw materials producers, manufacturers, transportation companies, warehousing facilities, and finally, retailers. The past couple of years have been anything but normal, and out of this, we’ve seen the global supply chain be completely disrupted. The stop-start nature of manufacturing plants caused delays in the production of goods, the increased demand for goods caused higher-than-normal seaport activity, and a mix of furloughs and worsening working conditions caused a shortage in truck drivers and railroad workers. These disruptions have been noticeable to consumers in many ways, most notably in the product delays of appliances, furniture, reduced supply of automobiles, and in general, longer waiting times. Not all the issues are a by-product of constrained supply however, a lot of the issues can be traced to increased consumer demand, as consumers are flush with cash and options for what to spend one’s money on are reduced.

Reasons for the Supply Constraints

Throughout the pandemic, manufacturing plants were forced to shut down either due to lockdowns or due to COVID outbreaks. These disruptions early on caused a backlog of the production of various goods, and unironically at the same time, consumer demand for goods skyrocketed. Throughout periods of lockdowns, most consumers were increasing their cash balances and had no services available to spend their money on, thus they were left with purchasing goods.

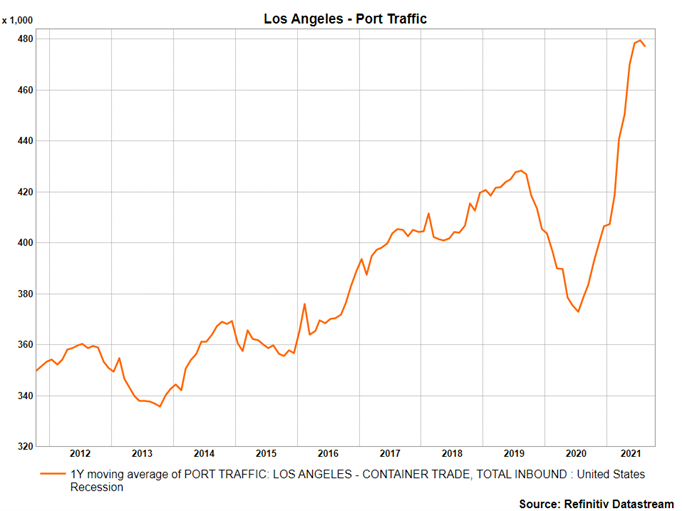

Typically, goods could be shipped via air cargo, but roughly half of all air cargo is through passenger flights, which as we know came to a near-grinding halt at the onset of the pandemic. This left sea freight as a primary option for the transportation of goods, but because there is a shortage of truck drivers who would normally take the cargo off the ships once they have landed at the port, the ports have been getting wildly congested. One of the largest ports in Los Angeles will begin operating 24 hours a day to decongest ships waiting at the port. Below we can see the substantial increase in traffic at the LA port over the last 12 months.

The combination of increased congestion at ports and labour shortage of truck drivers delivering the goods to warehouses and retailers have been the main contributors to the delays in products.

Highlighting the Importance of Semiconductors

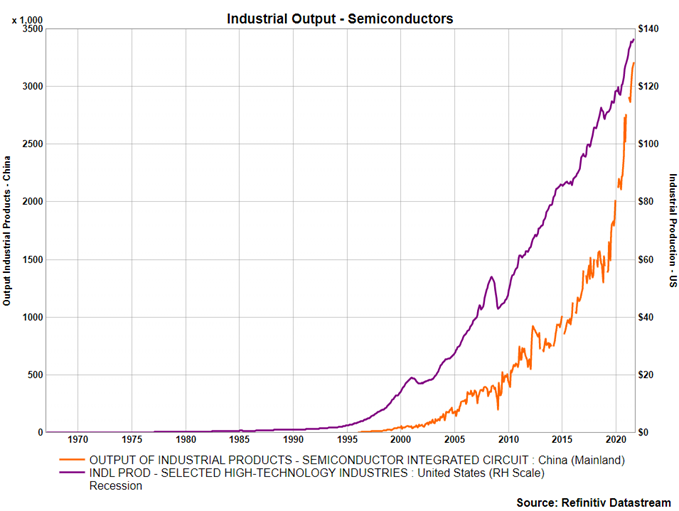

One of the main industries to be hit hard was the semiconductor industry, and this was most notable in the sale of automobiles. With respect to semiconductors, it is not as much an issue that the manufacturing of semiconductors has been disrupted, but more so that the pandemic has greatly accelerated the demand for semiconductors. The increased demand for semiconductors combined with the inability to transport semiconductors to where they needed to go has caused vehicle shortages and as a byproduct, rising prices of used vehicles. Below we can see the industrial output for semiconductors across both the US and China. Semiconductor manufacturers are responding to the demand by building new plants and increasing their production capacity, and as we can see, the manufacturing of semiconductors has only accelerated over the decades.

What This Means and How to Invest Going Forward

Our belief is that the resolution of supply chain constraints could have two possible contributing factors; 1) either the issues are not resolved within a year and rising costs will force consumers to shift their spending towards services or 2) the supply chain issues will be resolved within a year as ports are open longer and truck driving positions are filled due to more competitive wages, causing a reduction in port congestions, quicker delivery times, and reduced prices. Both outcomes 1 and 2 would cause inflation to decrease as both scenarios involve the price of goods decreasing, and the majority of inflation is made up of the price of goods.

We do not believe that the supply chain constraints will ease up overnight, and so between now and then, the sectors that we believe will perform well will continue to be raw materials producers, industrials, and financials. We believe financials will benefit as the supply chain issues causing an increase in inflation puts pressure on increasing interest rates sooner, and the financials sector will benefit from rising rates. Retailers will see tailwinds as consumers continue to demand more goods, but on the other hand, retailers may see headwinds of higher transportation costs and the reduced ability to supply goods to consumers. The outlook for semiconductors is even more clear, there is an ever-increasing demand for semiconductors and more specifically technological hardware, and semiconductor manufacturers increasing their output means more growth and higher revenues.

One thing is for sure, global supply chains are not meant to stop and start, and while we do not believe this will last forever, there remains a lot of work to be done. A few key pieces of information that we can glean from these global constraints have been that semiconductors manufacturers are not going anywhere and the demand is only going to increase, and the industrials and raw materials sector may continue to perform well until resolutions begin to appear.

Best wishes for your investing!

www.5iresearch.ca