Report Update

We have posted a report update on Enghouse Systems (ENGH). The company's rating was upgraded from the previous report. The global adoption of new technologies and work-from-home capabilities has acted as a tailwind for the company. We think due to strong sales growth, a robust bottom-line, and a reasonable valuation, that there is a lot to like here!

Read the latest updates by logging in here!

Market Update

Markets have experienced a tough few weeks with mostly week-over-week declines. There have been many concerns that have led to this broader market weakness, namely the Evergrande liquidity crisis, increasing yields, and a potential looming government shutdown. The Federal Reserve has indicated that they may begin bond-buying tapering as soon as November, and the prospect of increasing inflation has caused bond investors to sell their bonds in anticipation of higher rates. The energy sector has been performing well across both the Canadian and US markets as the price of oil rose as high as $79. Natural gas has also been performing well recently as supply has been constrained and demand is expecting to increase over the winter months. The biggest recent scare has certainly been the thought of systemic risk stemming from the Evergrande liquidity crisis. Below we dive deeper into the background and potential scenarios for where we go from here.

Background on the Evergrande Group

The Evergrande Group is ranked as being the second-largest property developer in China by revenue and it was ranked 122nd on Fortune Global 500. The company is headquartered in Shenzhen, China, and in 2018 it became the most valuable real estate company across the globe. The group also has investments in the electric vehicles market, internet and media companies, soccer clubs, and even theme parks. This gives us a backdrop to the sheer size and magnitude that Evergrande had, and how valued it was to the Chinese economy. Evergrande now has liabilities of over $300 billion, placing it as the largest real estate developer in the world by its debt size.

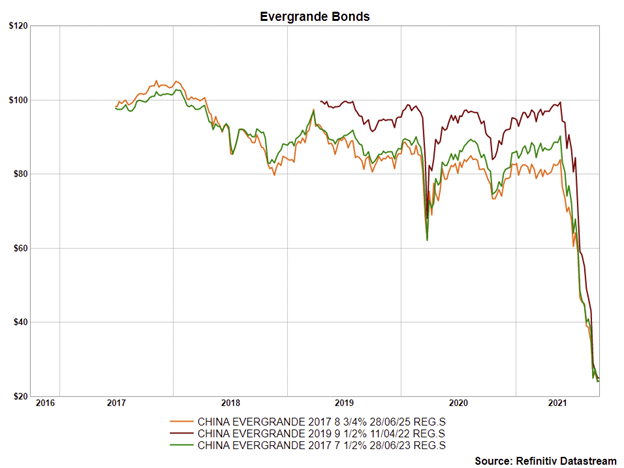

Evergrande Stock and Bond Prices

By looking at Evergrande’s stock and corporate bond prices, it is evident that cracks began to form in the narrative years ago. Clearly, there was weakness in the company’s fundamentals and as we detail in the next section, there were many red flags along the way.

Timeline of the Evergrande Liquidity Crisis

August 2017: Evergrande publicly announced that it would attempt to reduce its debt load for the first time, with a goal to reduce debt by June 2020.

November 2018: The Chinese central bank noted that Evergrande was one of the few large corporations that could cause systemic risk to the financial system.

August 2020: Authorities meet with Evergrande and several other large real estate companies to introduce new regulations and debt restrictions to limit debt levels taken on by these companies. Evergrande sells a significant stake in its property management unit for $3 billion and mentioned to the provincial government that it could encounter a liquidity issue.

September 2020: In an effort to bolster sales, Evergrande offers a 30% discount on some of its properties for a full month.

March 2021: Evergrande sells 10% of some of its internet and media companies for $2.1 billion.

June 2021: Evergrande continues to announce that it will sell off assets, and the credit rating agency, Fitch, downgrades Evergrande to a ‘B’ from a ‘B+’.

July 2021: A bank deposit with Evergrande is frozen by a bank, ordered by a court. Hong Kong banks begin to not extend debt to buyers of construction projects by Evergrande. Credit rating agencies continue to downgrade Evergrande’s rating.

August 2021: Evergrande continues to sell its investments in internet and media companies, credit rating agencies further downgrade the company, and construction projects begin to get halted. Evergrande publicly announces its potential for a liquidity crisis and default risks.

September 2021: Credit rating agencies begin to state that Evergrande is highly likely to default on its debts, and the company begins to miss payments on loans and requests for extensions.

Reasons for Evergrande's Liquidity Crisis

As we saw the crisis unfold for Evergrande in the previous timeline, there still looms one question – how did all of this begin? Over the past several years, mostly starting in late 2016, the Chinese government has implemented regulations to stifle the rapid rise in housing prices. Most of these regulations entailed how much real estate and mortgage debt financial institutions could give out and how much housing debt consumers could take on. As the years progressed, more and more restrictions came into place, which has created a weakening in the Chinese housing market. As we can see in the graph below, the Chinese housing market is still expanding but has slowed significantly over the past few years. This slowdown in real estate has created weakness in Evergrande’s operations and burdened its cash flows. Decreasing cash flows with a high debt load significantly impaired Evergrande’s ability to fund existing and new projects, and this is eventually the catalyst that sparked its liquidity crisis.

Is This Like 2008?

The most glaring question that most of us are asking ourselves is whether this liquidity crisis by one of the world’s largest real estate development companies will have a systemic risk to the global financial markets. We believe the answer is no. Our belief that this will not spill over into the global financial markets is based on significantly less amount of leverage used by Evergrande, fewer inter-dependencies and cross-party defaults, and physical assets held by Evergrande.

One of the first reasons that cause us to believe that this will not have global system impacts is that Evergrande’s operations and lenders are largely within China. The US banks have very little exposure to Evergrande and the liquidity crisis appears largely confined to Chinese banks. Also, unlike in 2008, this liquidity crisis is isolated to one single company, Evergrande, whereas in 2008, the majority of US banks had exposure to mortgage-backed securities.

From what we know so far, there is no financial leverage taken on by Evergrande that would cause a cascading effect of liquidation. In 2008, the main US banks all had exposure to financial leverage that was built on top of the promise that US consumers would pay back their mortgages. Once these mortgages began to fail and consumers began to default, the leverage that was built on top of them collapsed, causing assets held by the main US banks to evaporate. The assets held by Evergrande are physical real estate properties or investments in other companies, and this gives us the belief that the company is able to continue to sell physical assets to cover its near-term debts. Evergrande has liabilities totaling just over $300 billion, whereas in 2008, the Lehman Brothers had liabilities totaling over $600 billion, and that was just one of the US banks to fail.

Conclusion

While the liquidity crisis and potential collapse of Evergrande has been brought on suddenly to the markets, we do not believe that it poses a severe threat to the global financial markets. The slowing down of the Chinese real estate market has been happening for years and there is very little leverage that would act as a multiplier if Evergrande did collapse. Nevertheless, it acts as an important lesson in the significant accumulation of debt in any one company and the effects that weakening sales or operations can have on the liquidity of a company. We do not believe this is the last that we will hear of Evergrande, but it should not dampen the outlook for the North American markets.

Best wishes for your investing!

www.5iresearch.ca