Business Focus

Manulife (MFC)

Manulife Financial (MFC) is a Canadian multinational financial services company that operates under ‘Manulife’ in Canada and Asia, and through its John Hancock division in the US. It offers services include life insurance, wealth management, and investment services to individuals and businesses.

Sun Life (SLF)

Sun Life Financial (SLF) is a financial services company that offers savings, retireent, and pension products globally. Its operations include five business segments: Asset Management, Canada, US, Asia, and Corporate. Its services include life insurance, health insurance, and investment management.

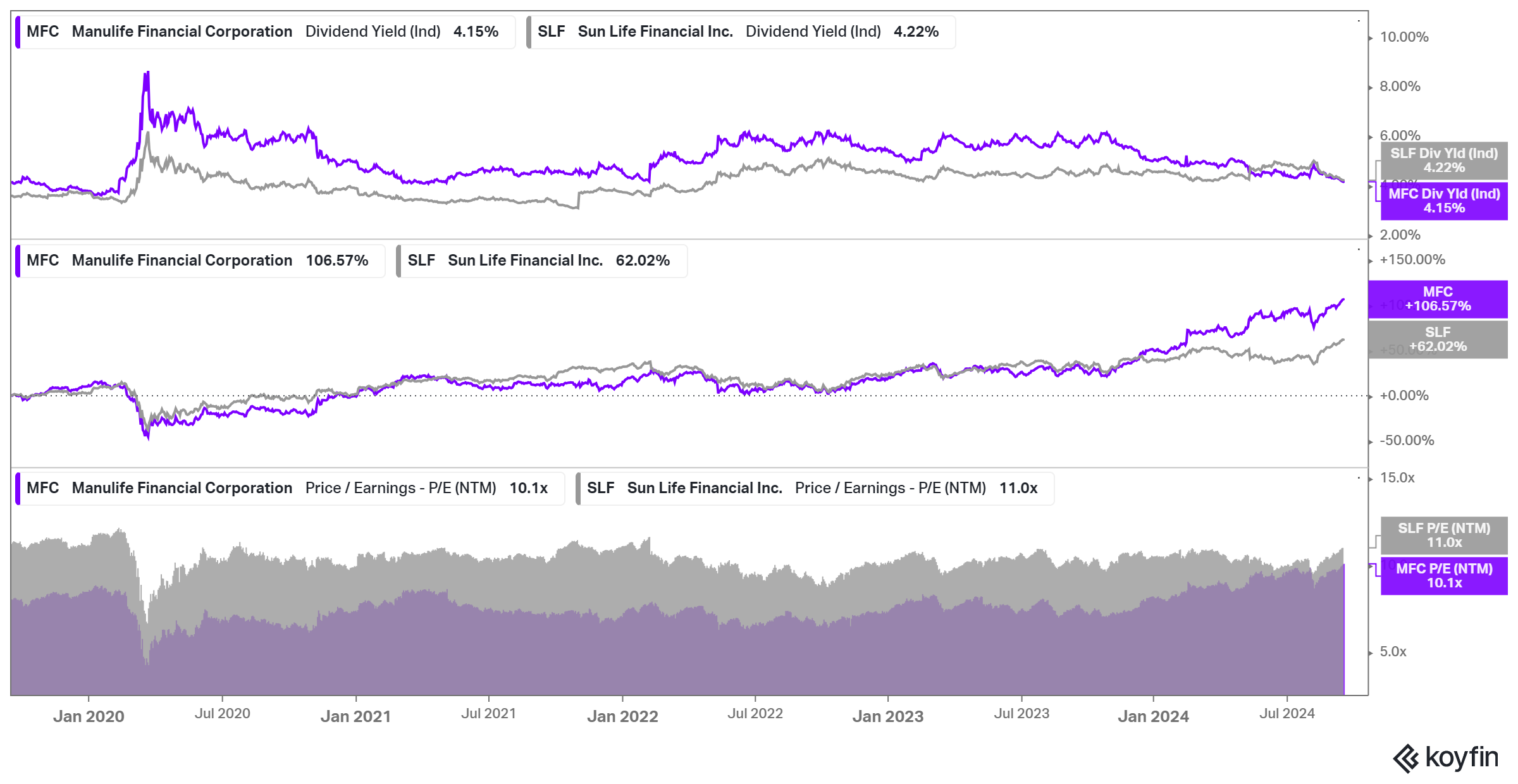

Looking at valuation, we can see that both names are trading at similar levels (SLF at 11X forward earnings and MFC at 10X forward earnings). Although, SLF has been trading at a premium valuation relative to MFC over the past few years, and we think that MFC’s recent strong execution has caused it to re-rate. Both names have similar dividend yields (around the low 4% level). We can see how since early 2024, MFCs returns have begun to take off, and this is largely attributable to a combination of a previously cheap valuation and execution in cost management.

Financial Metrics and Forward Estimates

The table below compares the financial metrics and stats between MFC and SLF. MFC is a larger company than SLF, and shares of MFC have seen very strong recent momentum due to the company’s execution over the past year. We can see that its forward earnings growth estimates are expected to be higher than SLF’s, which is likely why it has seen such positive momentum. MFC has been focusing on costs recently, driving up its margin profile, and we can see this through its higher gross and net profit margins than SLF. Both names have similar debt profiles, but SLF has a strong ROE.

Investment Outlook

Both names have performed well over the years and have sustainable dividend policies, but recent performance has begun to shift from prior years. We think with declining rates, that both of these names have certain tailwinds, particularly in the asset management space, but MFC has shown strong execution in its recent earnings results. We think that investors looking for a strong momentum play and a larger name might prefer MFC today, however, for a more conservative play, we give SLF the edge due to its longer track record of success in margin expansion, causing it to trade at a premium to MFC, and its generally lower levels of volatility.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Research for Today, Invest for Tomorrow.

Twitter: @5iChris

Comments

Login to post a comment.