Grocery is a non-cyclical business as no matter what happens with the economic situation, consumers are going to keep buying groceries. The business has some pricing power, allowing most grocers to have increased prices this year to offset cost inflation without losing customers. It is an attractive industry due to its recurring nature.

Business Focus

Loblaws Companies Limited (L):

Loblaws (L) is the largest Canadian food retailer, and some of its notable brands include President’s Choice, No Name, and Joe Fresh. The company operates supermarkets, drug stores, liquor stores, and clothing stores. It has two reportable operating segments, its retail and financial services business lines. Its retail segment includes corporate and franchise-owned retail food and associate-owned drug stores, and includes in-store pharmacies, health care services, other health and beauty products, and apparel. Its financial services segment provides credit card and everyday banking services, insurance brokerage services, and other. Management has been repurchasing shares at a fairly aggressive pace, indicating that management believes shares are undervalued.

Metro (MRU) is a leading food and pharmacy company in Quebec and Ontario. It operates a network of over 1,600 retail outlets in Canada. MRU operates food stores under different banners including Metro, Metro Plus, Super C, Food Basics, Adonis and Première Moisson, as well as drugstores under the banners Jean Coutu, Brunet, Metro Pharmacy and Food Basics. More specifically, the company operates 983 food stores across Ontario and Quebec, and 640 pharmacies across Ontario, Quebec, and New Brunswick. The company also has a strong buyback program in place, and it has a good track record of solid organic revenue growth.

Financial Performance:

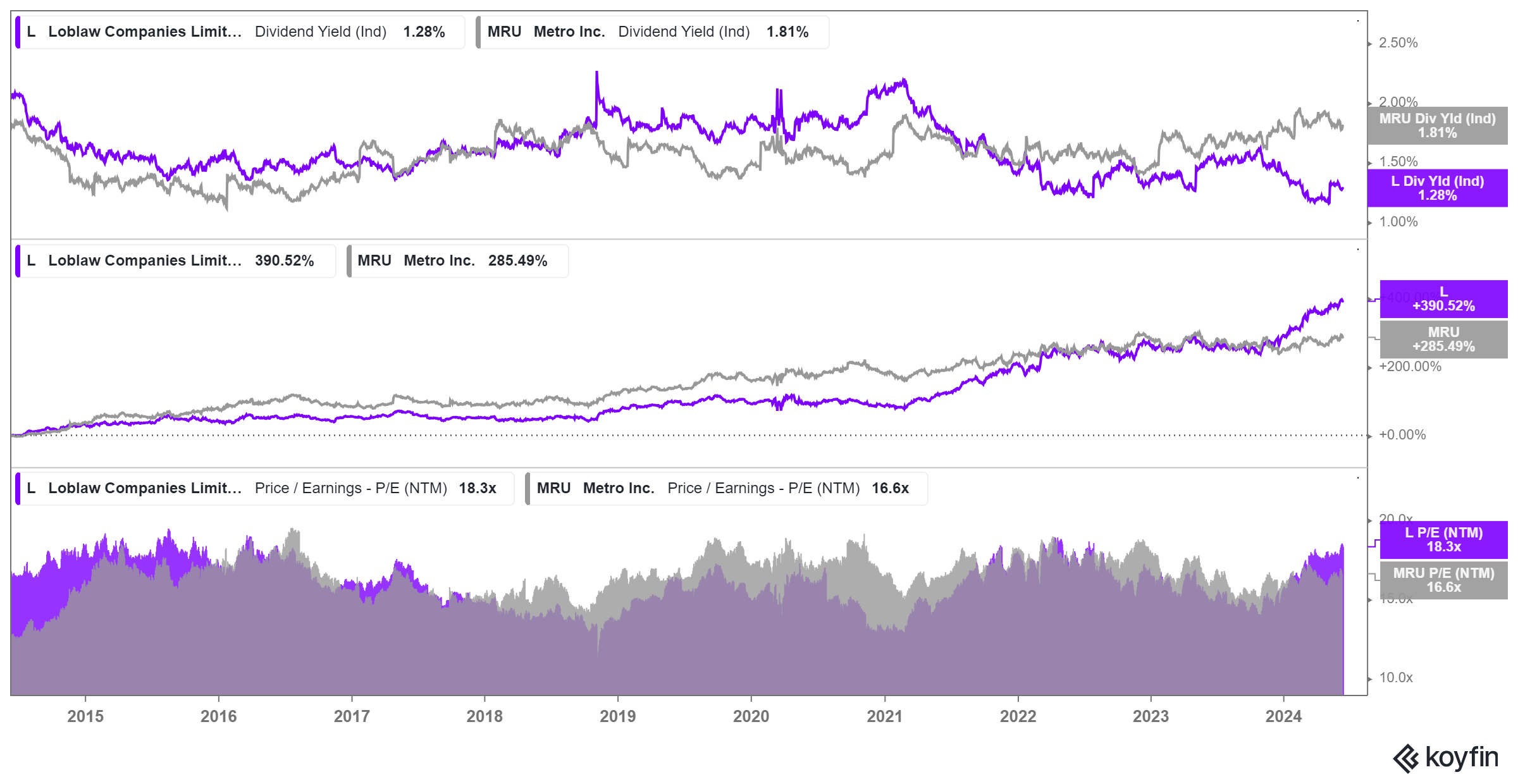

In terms of valuation, looking at L versus MRU over the past 10 years we can see that both names have largely traded in line performance-wise, however, recently Loblaws has surged in price. Loblaws has reported a few quarters of strong earnings results with stable gross margins and operating leverage around 4% to 6% EBIT growth. The company is also looking at expanding beyond food to national brands in categories like toys and apparel. Loblaws’ dividend yield of 1.3% has now fallen below MRU at 1.8%, but this is mostly due to a rapid rise in Loblaws’ share price. L has also seen its forward earnings multiple expand in recent quarters above MRU, again mostly due to strong earnings and price appreciation. Loblaws has seen its dividend grow at an annualized pace of 6.4% over the past 10 years, while MRU has shown a stronger dividend growth rate, at annualized 10-year rate of 13.3%. Given the strong results from L, we believe its premium valuation is warranted, but for investors specifically seeking yield, MRU looks to have a stronger dividend appreciation policy in place.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Financial Metrics and Forward Estimates:

The table below compares the financial metrics and stats between L and MRU. Loblaws is roughly three times the size of MRU, and it is expecting to see strong margin growth in the forward one-year period. Loblaws has a more attractive margin profile, including its higher ROE, gross margin, although it does have a higher debt profile.

Investment Outlook:

Between L and MRU, both names are fairly attractive within the Canadian consumer defensive sector, and both of these names have a healthy dividend yield, with strong historical dividend growth rates, and employ a healthy buyback strategy. Loblaws is the larger name of the two, and it has a more geographically diverse set of operations. We like the recent momentum and earnings results from L, but for an investor specifically seeking a high dividend yield with good annual dividend growth, we feel MRU is a slightly stronger candidate. Overall, given the larger size, better forward earnings growth guidance, and higher margin profile, we would give Loblaws the slight edge today. For other editions of our ‘Stock Teasers’, check out our latest blog on 'Cross-Border Stocks: Restaurant Brands International (QSR) and Coca-Cola Consolidated (COKE)'.

Research for Today, Invest for Tomorrow.

Twitter: @5iChris

Disclosure: The analyst(s) responsible for this report do not have a financial or other interest in the securities mentioned.

Comments

Login to post a comment.