5i Research Weekly Rockets and Duds

Welcome to week four of 5i Research's market ROCKETS AND DUDS

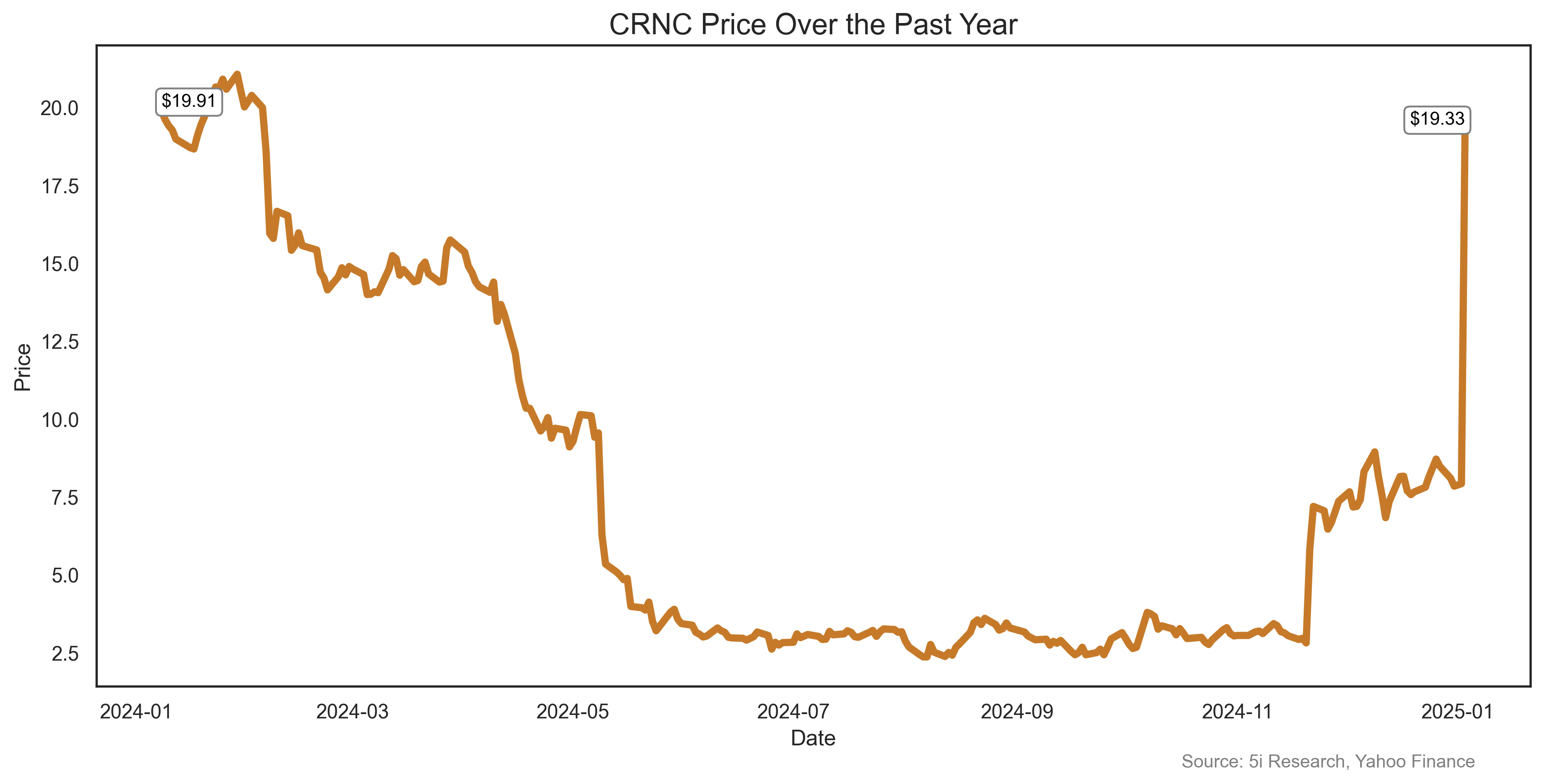

Cerence Inc. $CRNC

: We have a prediction: We bet that nearly every weekly big mover, or loser, this year will be, in some way, related to AI. This week continues the trend, with Cerence surging 152% over the past two weeks. Its CaLLM service is not a meditation app, it is a family of large language models. The stock surged on news that Cerence has expanded its collaboration with the king of AI, Nvidia. The two hope to improve how cars respond to their drivers' voices. Maybe this might solve a few arguments between couples fighting over which direction to take.

: We have a prediction: We bet that nearly every weekly big mover, or loser, this year will be, in some way, related to AI. This week continues the trend, with Cerence surging 152% over the past two weeks. Its CaLLM service is not a meditation app, it is a family of large language models. The stock surged on news that Cerence has expanded its collaboration with the king of AI, Nvidia. The two hope to improve how cars respond to their drivers' voices. Maybe this might solve a few arguments between couples fighting over which direction to take.

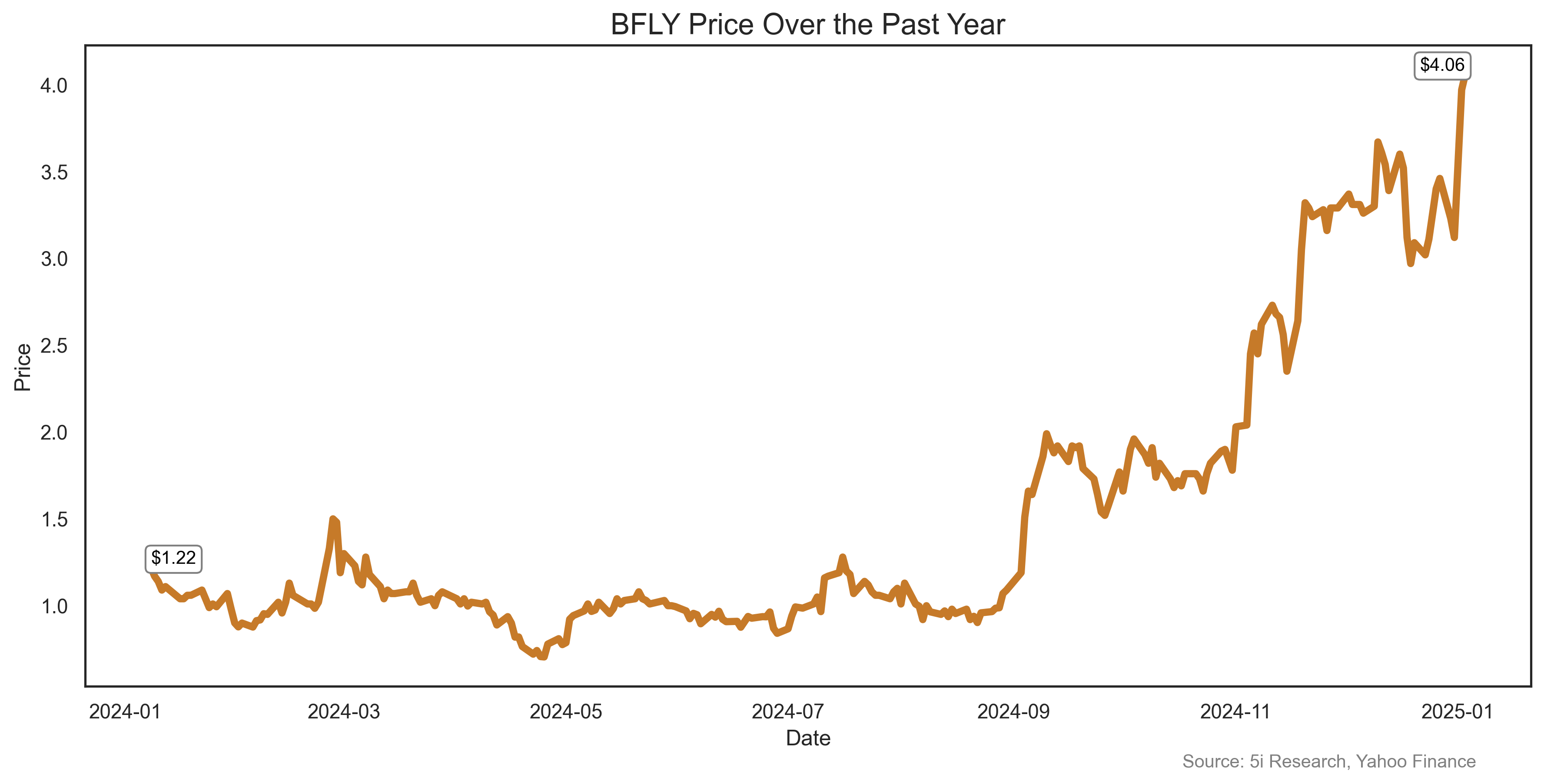

Butterfly Network $BFLY

Who knew butterflies needed a social media app in order to hook up? Hey, we're not biologists, we're stock people! Butterfly Network, which actually makes medical imaging equipment, is up 30% this year already. The only news: TD Cowen raised its price target to $4.50 per share from $3.00, stating the company is 'on track to sustain strong double-digit revenue growth and reach cash flow break-even in 2027'.

Who knew butterflies needed a social media app in order to hook up? Hey, we're not biologists, we're stock people! Butterfly Network, which actually makes medical imaging equipment, is up 30% this year already. The only news: TD Cowen raised its price target to $4.50 per share from $3.00, stating the company is 'on track to sustain strong double-digit revenue growth and reach cash flow break-even in 2027'.

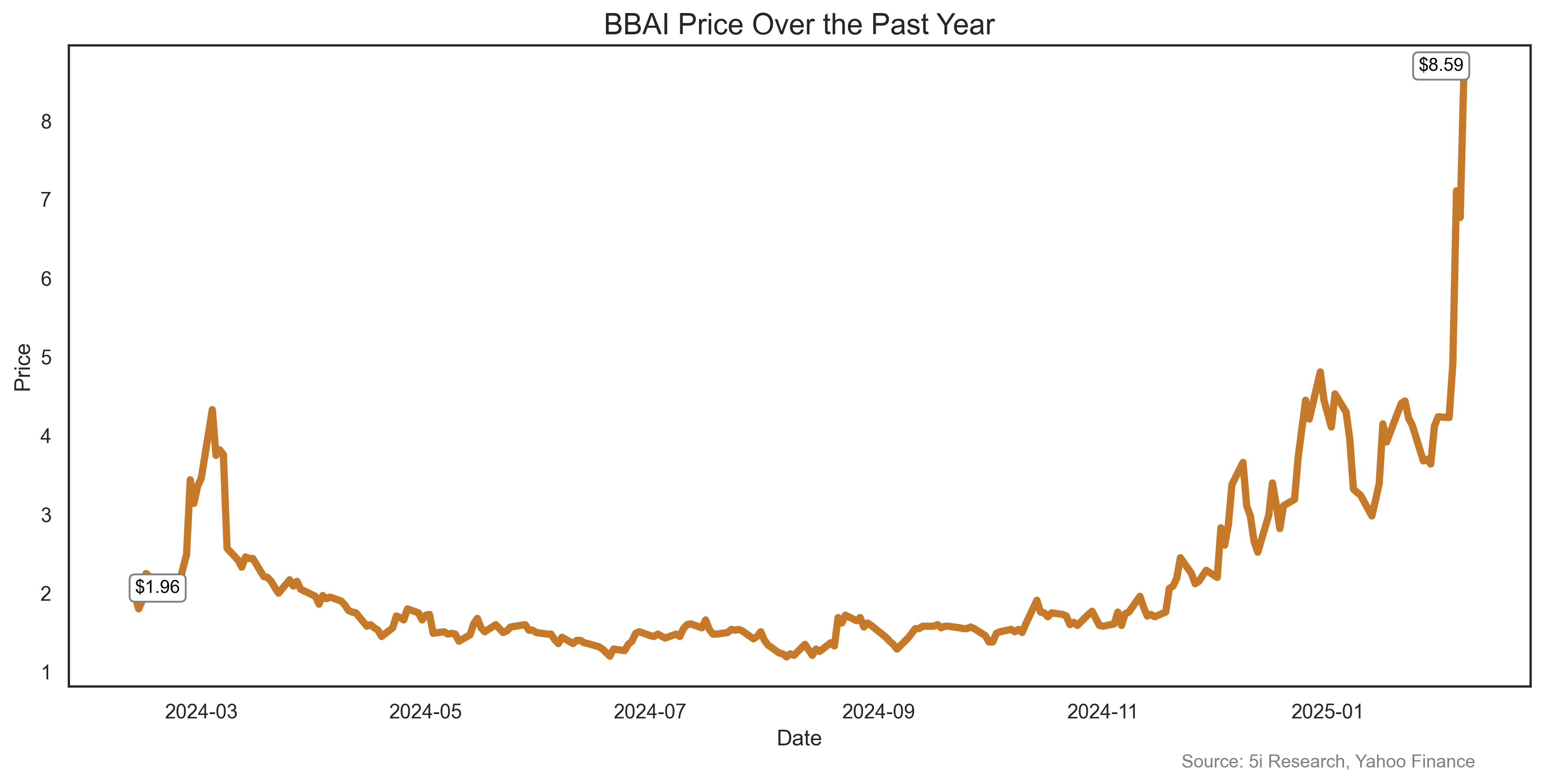

BigBear.AI Holdings Inc. $BBAI

Have you ever had difficulty in deciding what to choose when you are building a stuffed bear at Build-A-Bear? Well, why not consult artificial intelligence? BigBear stock rose 45.6% over the past two weeks. The company, which actually makes software that uses AI to support its customers decision-making processes, rose on news of a debt-swap, which was not really material news. But hey, it's got AI right in the name of the company, so that means we should buy, right?

Have you ever had difficulty in deciding what to choose when you are building a stuffed bear at Build-A-Bear? Well, why not consult artificial intelligence? BigBear stock rose 45.6% over the past two weeks. The company, which actually makes software that uses AI to support its customers decision-making processes, rose on news of a debt-swap, which was not really material news. But hey, it's got AI right in the name of the company, so that means we should buy, right?

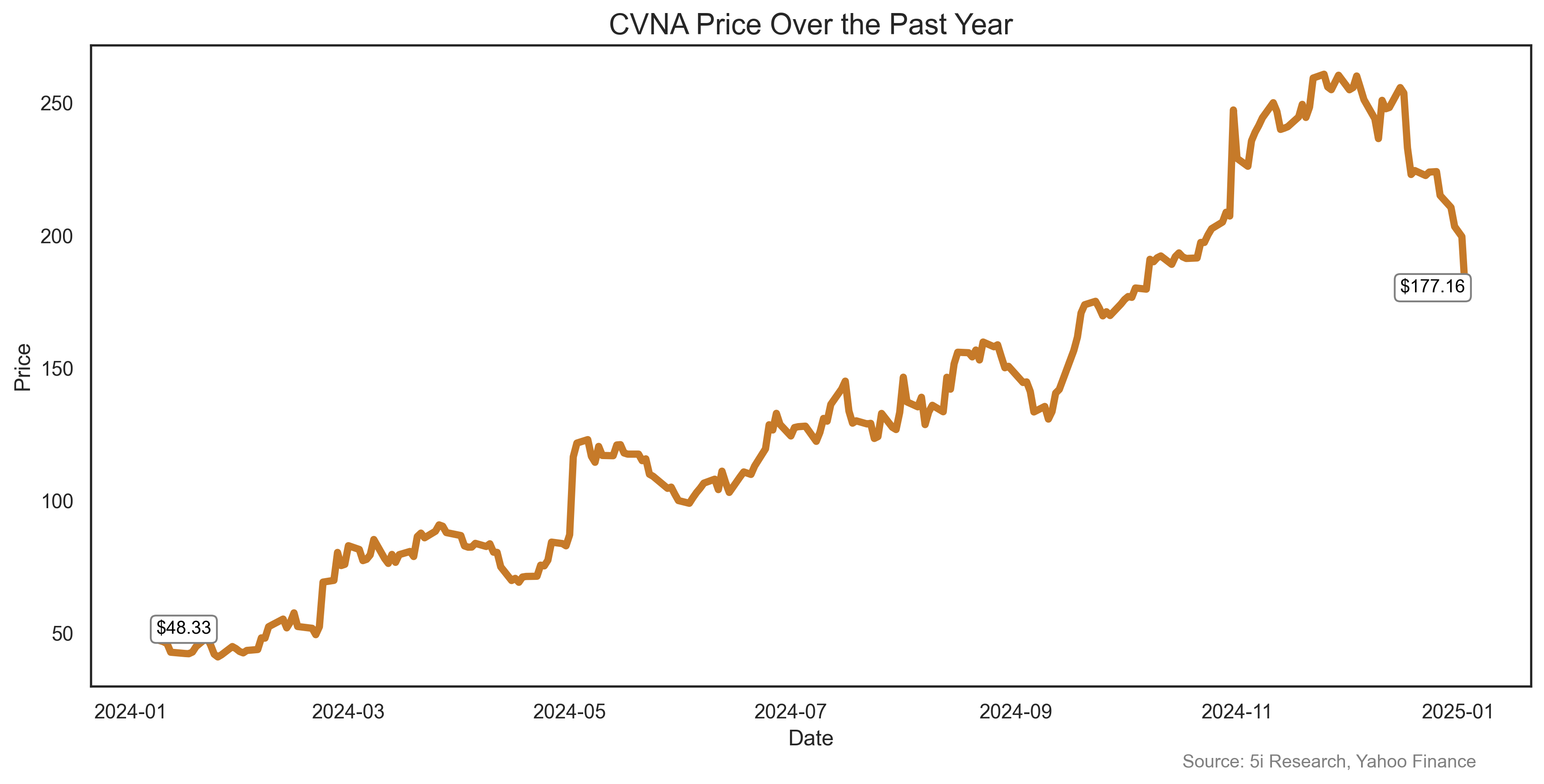

Carvana Co $CVNA

Carvana, one of the hottest stocks in 2024, fell 21% over the past two weeks, with most of the losses on Friday January 3. Short seller Hindenburg came out with a short attack on the company, calling the company's dramatic turnaround 'a mirage'. Short interest is 10%, or 12.4 million shares. Carvana is an online platform for buying used cars. Earnings per share are expected to double this year, after the company has incurred losses since inception to 2024. The stock, which rose 284% last year, might see its joyride end for shareholders if Hindenburg is right.

Carvana, one of the hottest stocks in 2024, fell 21% over the past two weeks, with most of the losses on Friday January 3. Short seller Hindenburg came out with a short attack on the company, calling the company's dramatic turnaround 'a mirage'. Short interest is 10%, or 12.4 million shares. Carvana is an online platform for buying used cars. Earnings per share are expected to double this year, after the company has incurred losses since inception to 2024. The stock, which rose 284% last year, might see its joyride end for shareholders if Hindenburg is right.

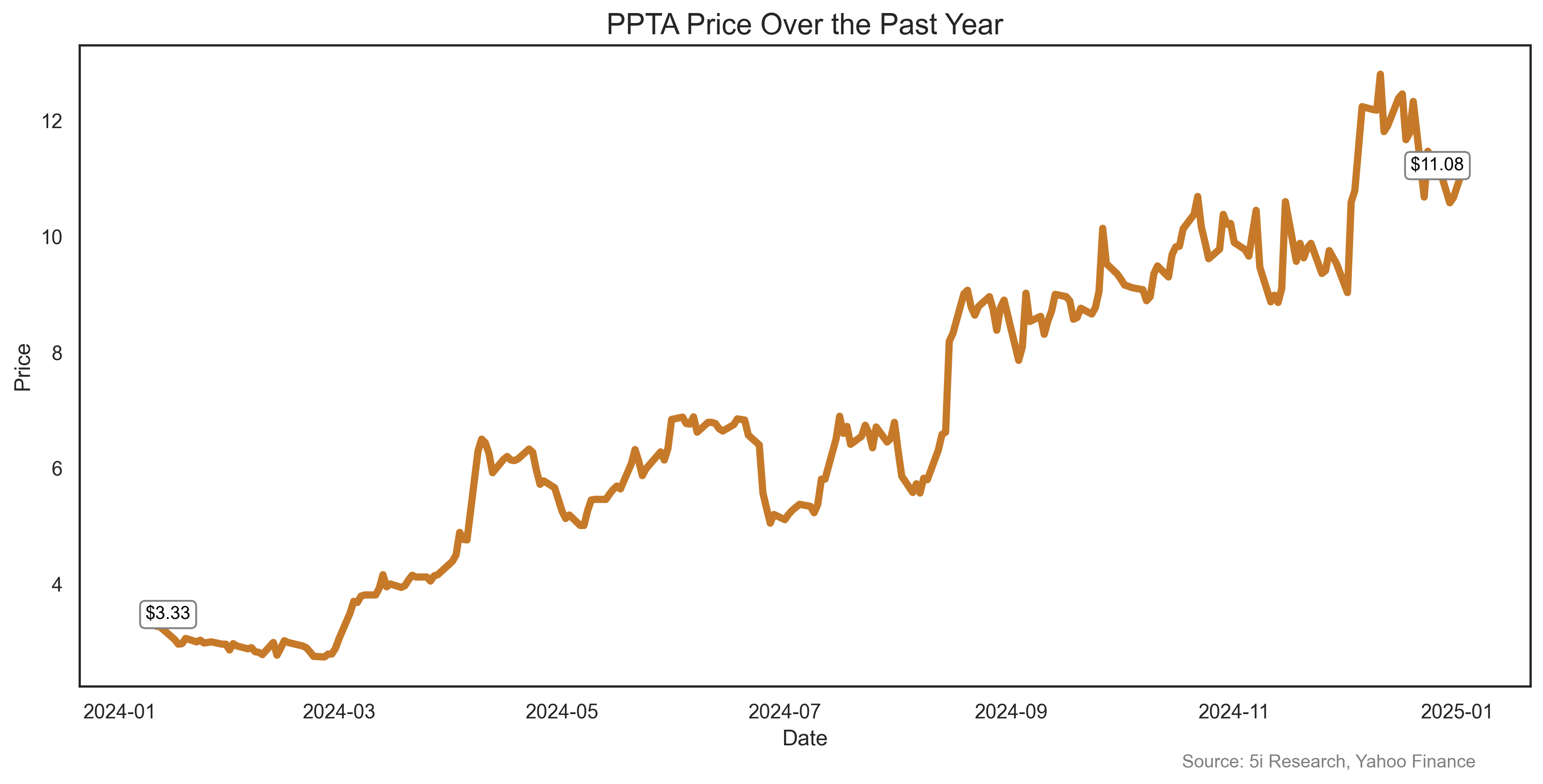

Perpetua Resources Corp. PPTA

Perpetua, a developer working on a potential antimony and gold mine in Idaho, fell 14% on December 23 on no news and is down 10% over the past two weeks. It has no revenue yet. On January 3, it was issued a permit for its Idaho Mine, so its decline might be short-lived. Antimony is used to increase the hardness of alloys, with lead alloys for batteries, with lead/copper/tin alloys for machine bearings. It is also used in automotive clutch and brake parts. The other major use is as antimony trioxide which is used for the production of flame retardant chemicals. There. Now you know.

Perpetua, a developer working on a potential antimony and gold mine in Idaho, fell 14% on December 23 on no news and is down 10% over the past two weeks. It has no revenue yet. On January 3, it was issued a permit for its Idaho Mine, so its decline might be short-lived. Antimony is used to increase the hardness of alloys, with lead alloys for batteries, with lead/copper/tin alloys for machine bearings. It is also used in automotive clutch and brake parts. The other major use is as antimony trioxide which is used for the production of flame retardant chemicals. There. Now you know.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.