5i Research Weekly Rockets and Duds

Welcome to week four of 5i Research's market ROCKETS AND DUDS

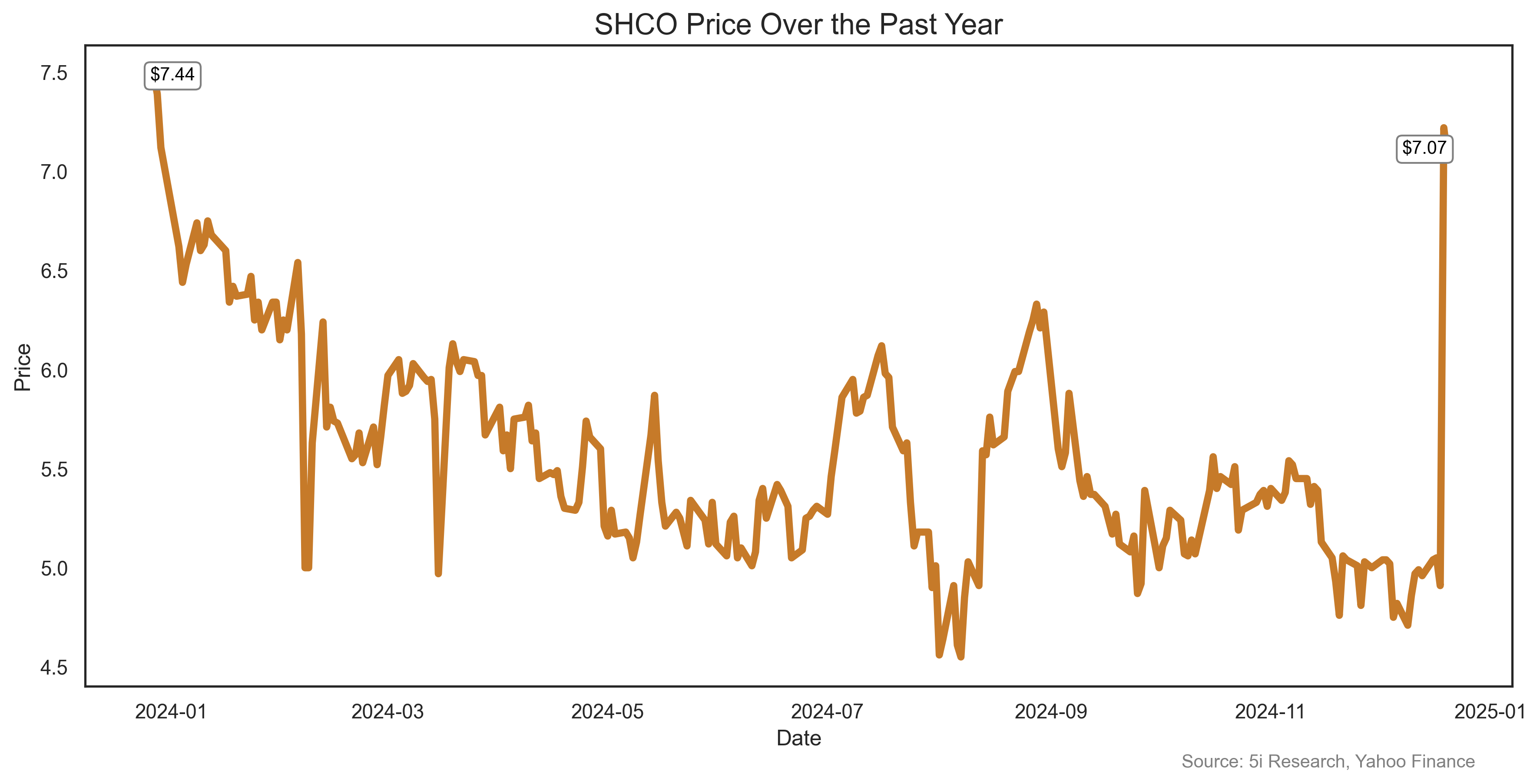

Soho House & Co Inc. SHCO ![]()

![]() Did you ever want to be part of an exclusive club? Soho gave you the chance. With 45 venues and 200,000 paying members, Soho has struggled with the competing goals of being a private club and a public company ever since its 2021 Initial Public Offering. This week, shares rose 43% as it decided 'private' was the way to go, with Soho receiving a privatization proposal at an 83% premium to its share price. That money will buy a lot of fancy cocktails! But don't get too excited. The takeover bid is still 37% below the stock's peak three years ago, and even with the giant premium the stock is still down 1% for the year. Ya, well, I never wanted to join your stupid club, anyway.

Did you ever want to be part of an exclusive club? Soho gave you the chance. With 45 venues and 200,000 paying members, Soho has struggled with the competing goals of being a private club and a public company ever since its 2021 Initial Public Offering. This week, shares rose 43% as it decided 'private' was the way to go, with Soho receiving a privatization proposal at an 83% premium to its share price. That money will buy a lot of fancy cocktails! But don't get too excited. The takeover bid is still 37% below the stock's peak three years ago, and even with the giant premium the stock is still down 1% for the year. Ya, well, I never wanted to join your stupid club, anyway.

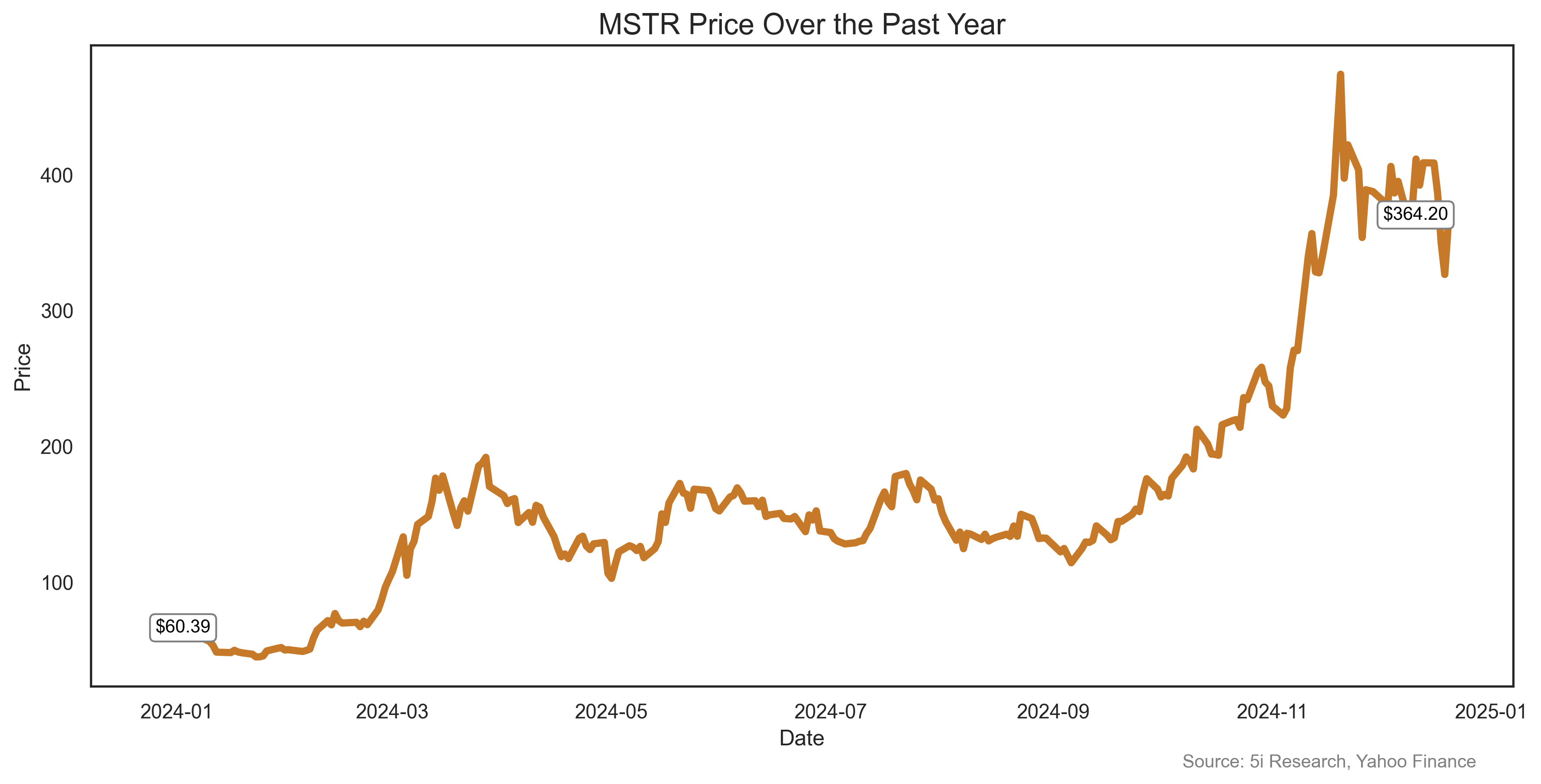

MicroStrategy Incorporated MSTR ![]()

![]() True or False: Bitcoin hit a new all-time high last week, so MicroStrategy, the largest corporate holder of bitcoin in the world, also did well. Answer: FALSE. MicroStrategy fell 11% last week as investors worried about whether it qualifies for inclusion into the prestigious S&P 500 Index. To qualify for the index, companies need to be profitable for four quarters, and MicroStrategy has not been, since its earnings bounce like a yo-yo because of its bitcoin holdings. MicroStrategy hopes to fix this issue by adopting new accounting standards next year. That sounds like an easy solution to fix losses. Why doesn't every company do this?

True or False: Bitcoin hit a new all-time high last week, so MicroStrategy, the largest corporate holder of bitcoin in the world, also did well. Answer: FALSE. MicroStrategy fell 11% last week as investors worried about whether it qualifies for inclusion into the prestigious S&P 500 Index. To qualify for the index, companies need to be profitable for four quarters, and MicroStrategy has not been, since its earnings bounce like a yo-yo because of its bitcoin holdings. MicroStrategy hopes to fix this issue by adopting new accounting standards next year. That sounds like an easy solution to fix losses. Why doesn't every company do this?

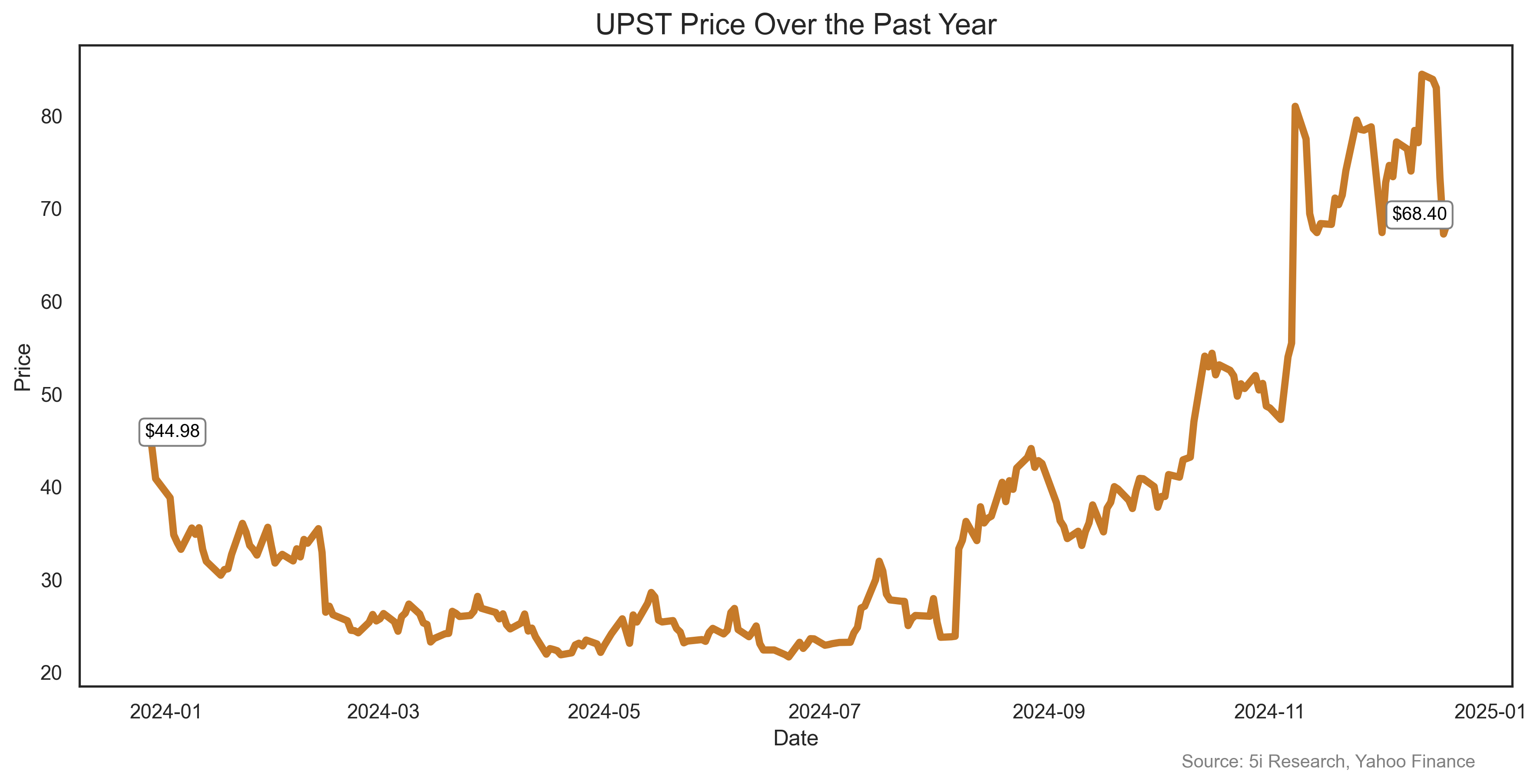

Upstart Holdings Inc. UPST ![]()

![]() Upstart provides a cloud based AI lending platform to reduce the risk of lending to bank partners. How about reducing the risk for stock holders? The stock fell 19% last week, even though it got a broker upgrade. The stock is up 67% for the year, though, so maybe the credit robots really do know what they are doing after all.

Upstart provides a cloud based AI lending platform to reduce the risk of lending to bank partners. How about reducing the risk for stock holders? The stock fell 19% last week, even though it got a broker upgrade. The stock is up 67% for the year, though, so maybe the credit robots really do know what they are doing after all.

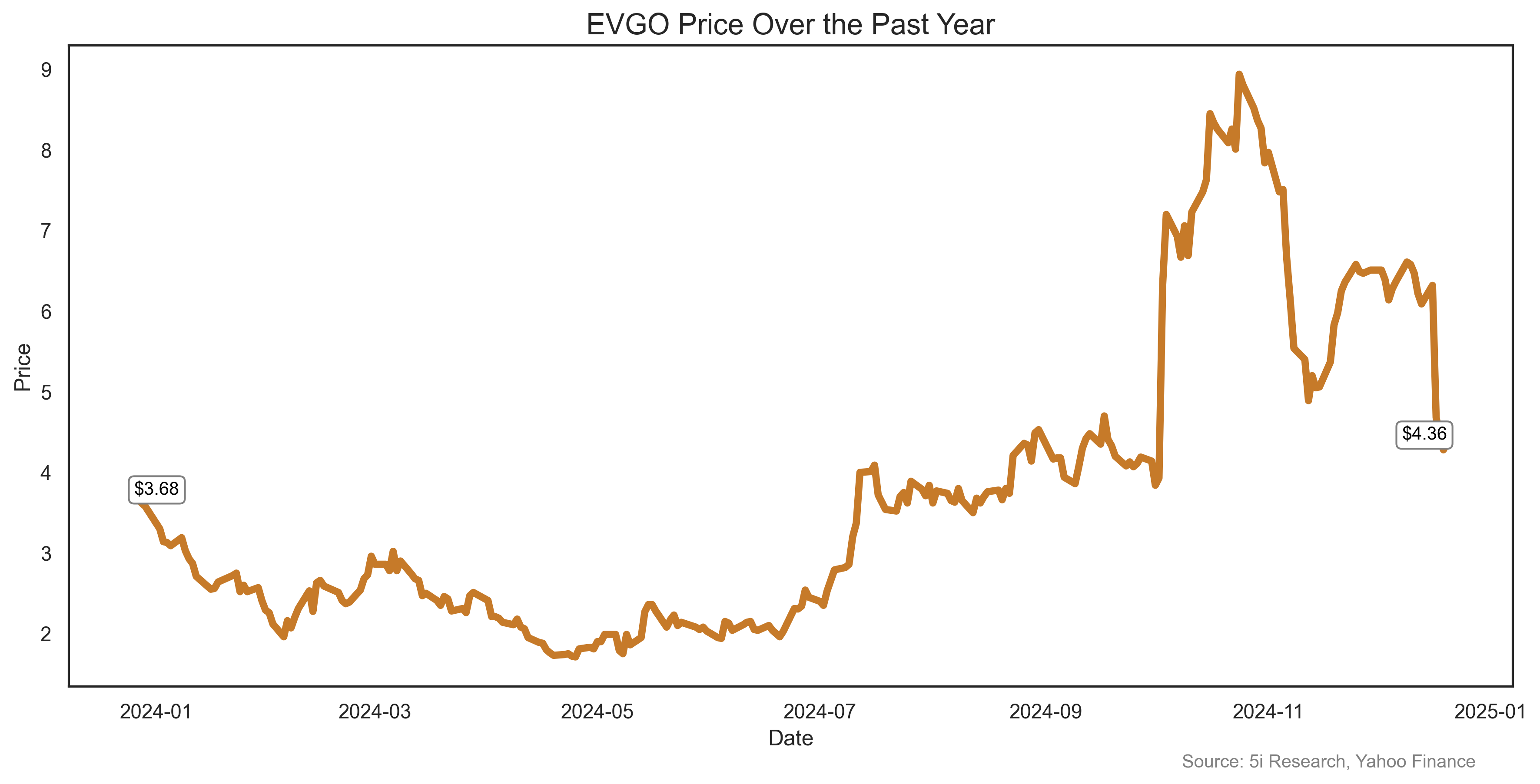

EVGO Inc. EVGO ![]()

![]() QUIZ: EVGO, an electric vehicle fast charging network, fell 28% this week because: A) The company finally realized that an electrical cord doesn't go that far. B) Investors decided Elon Musk was going to be too busy running the US government and was abandoning the EV industry. C) EVgo Holdings, decided to sell 23 million shares at $5.00 each. ANSWER: C

QUIZ: EVGO, an electric vehicle fast charging network, fell 28% this week because: A) The company finally realized that an electrical cord doesn't go that far. B) Investors decided Elon Musk was going to be too busy running the US government and was abandoning the EV industry. C) EVgo Holdings, decided to sell 23 million shares at $5.00 each. ANSWER: C

Hertz Global Holdings Inc. HTZ ![]()

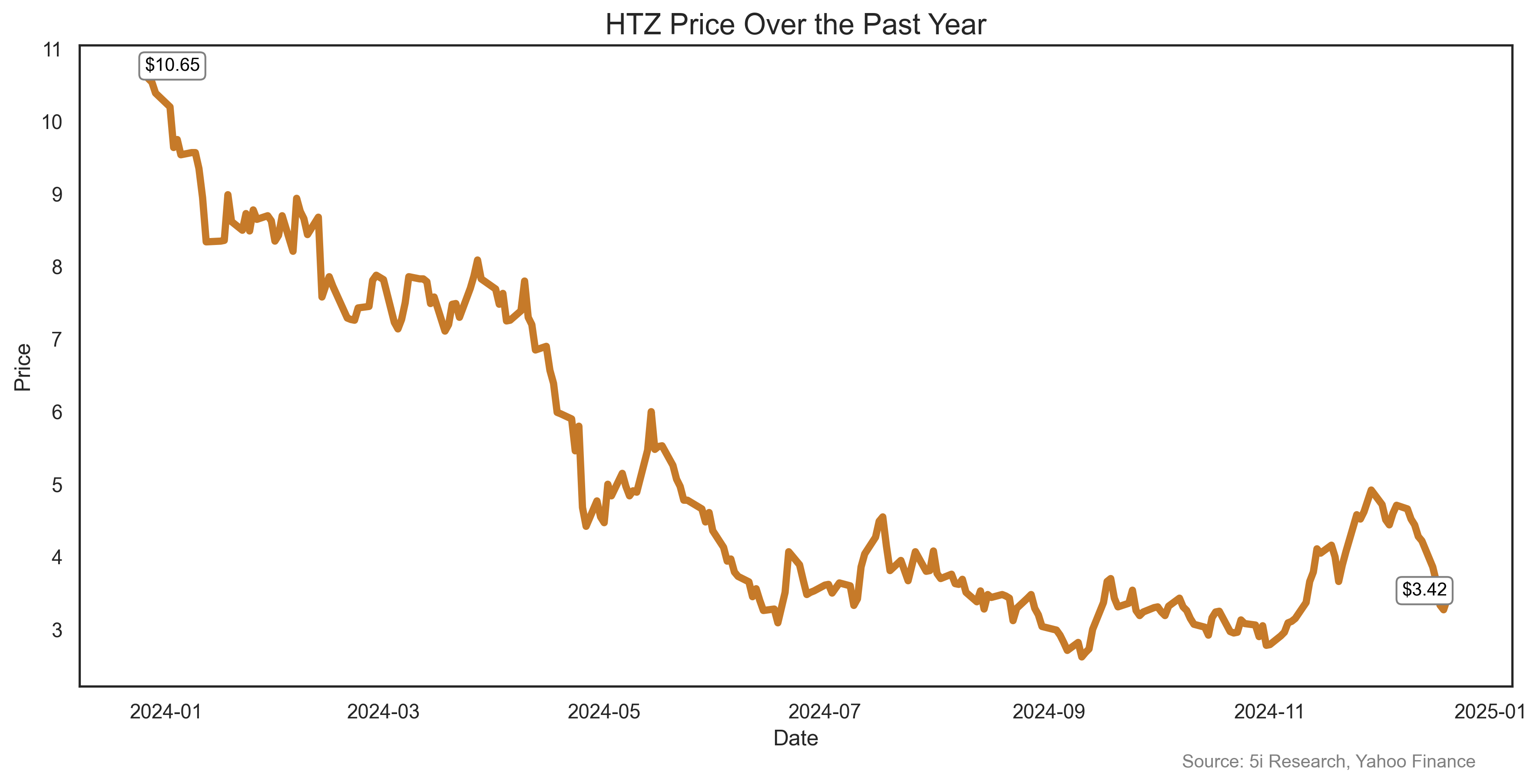

![]() Hertz: A global car rental company. HURTS: what it feels like to own Hertz stock. The stock fell 19% last week, bringing its year-to-date loss to 67%. With a short interest of 39.6%, many are betting that Hertz, which filed for bankruptcy during the Covid pandemic, is going to see financial turmoil again. Last week Hertz sold junk bonds and bond investors worried further. Fitch put its outlook to 'negative'. With $18 billion in debt, and more losses predicted in 2025, Hertz shareholders must feel they are heading down a steep hill, with no brakes in their rental car.

Hertz: A global car rental company. HURTS: what it feels like to own Hertz stock. The stock fell 19% last week, bringing its year-to-date loss to 67%. With a short interest of 39.6%, many are betting that Hertz, which filed for bankruptcy during the Covid pandemic, is going to see financial turmoil again. Last week Hertz sold junk bonds and bond investors worried further. Fitch put its outlook to 'negative'. With $18 billion in debt, and more losses predicted in 2025, Hertz shareholders must feel they are heading down a steep hill, with no brakes in their rental car.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.