5i Research Weekly Rockets and Duds

This week's 5i Research Rockets

and Duds

and Duds

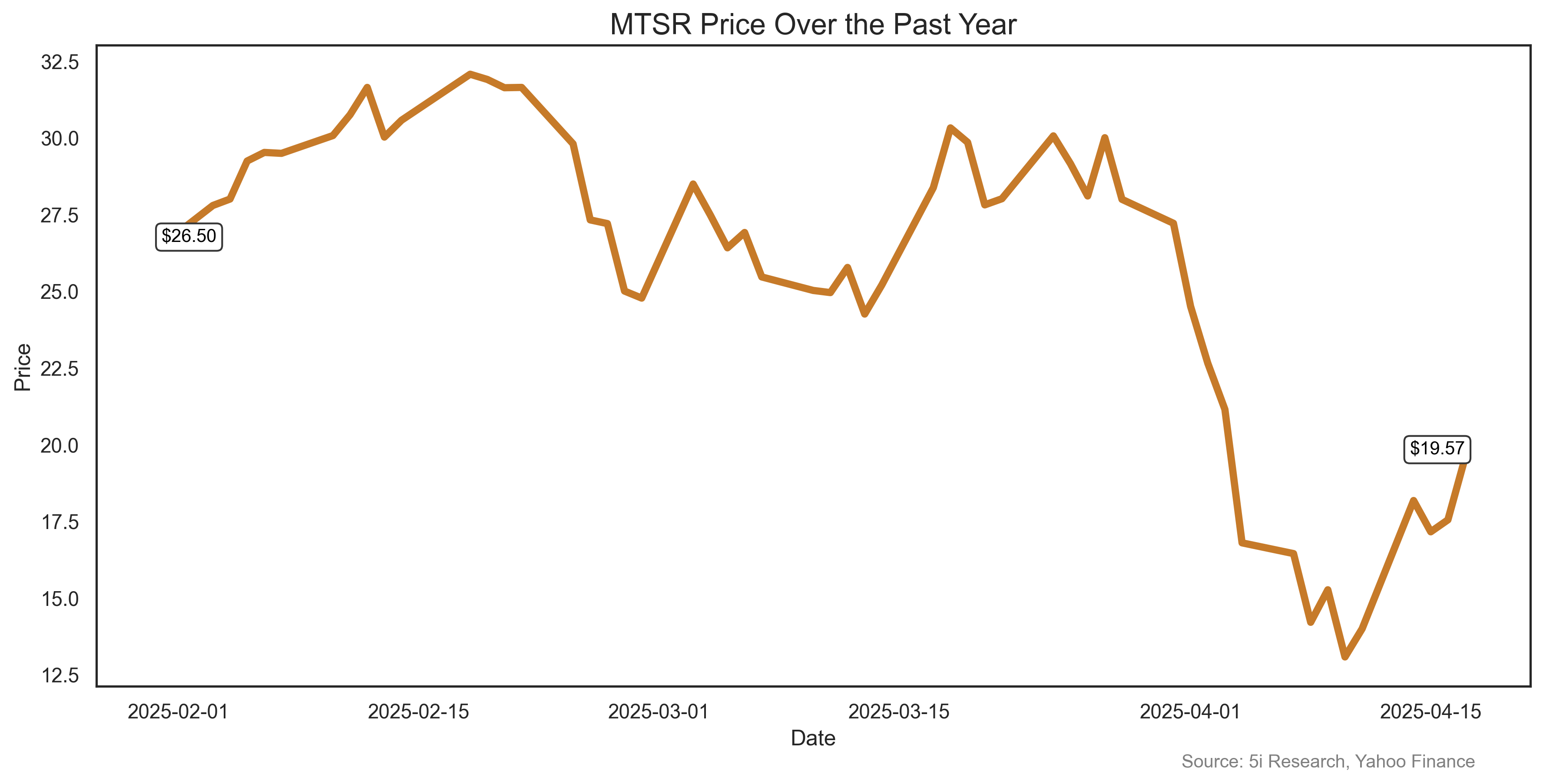

Have you ever been in, say, a running race, and as you head for the finish line in a big sprint you arch rival trips, falls, and allows you to win? Well, it's not quite the same but Metsera shares rose 50% last week as Pfizer dropped out of developing its GLP-1 obesity drug, leaving more room for small competitors in the field such as MTSR. After a tough debut, the news allowed MTSR stock to finally rise above its January IPO price.

Have you ever been in, say, a running race, and as you head for the finish line in a big sprint you arch rival trips, falls, and allows you to win? Well, it's not quite the same but Metsera shares rose 50% last week as Pfizer dropped out of developing its GLP-1 obesity drug, leaving more room for small competitors in the field such as MTSR. After a tough debut, the news allowed MTSR stock to finally rise above its January IPO price.

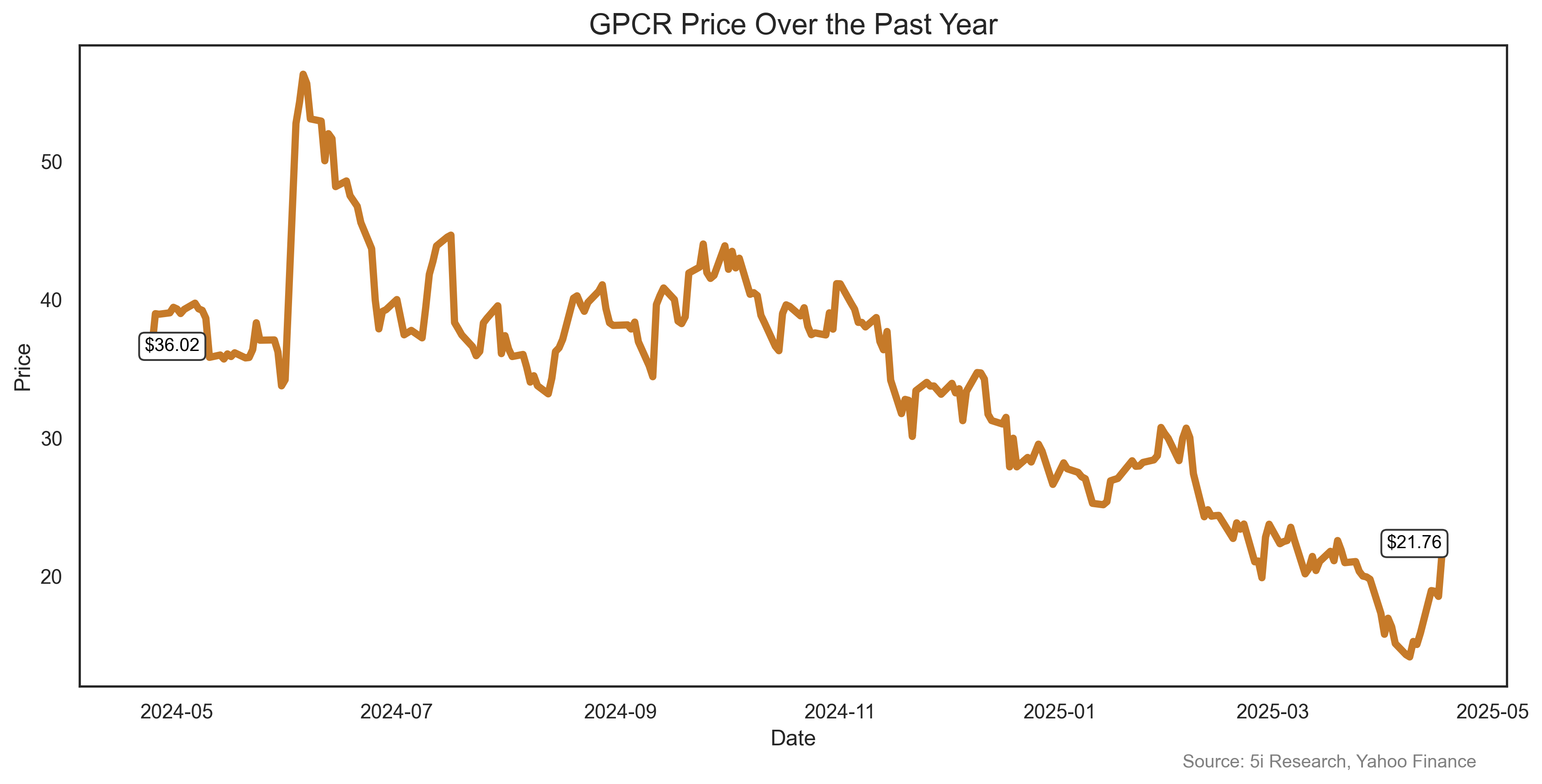

In our race analogy above, Structure is also in the same race. But its move was more like another runner picking it up and carrying it across the finish line. Structure benefited from good clinical results from Eli Lilly and Company (LLY), showing that its new pill is good for diabetes management AND weight loss. JP Morgan noted that LLY's news should be very good for Structure Therapeutics, in the same field of development.

In our race analogy above, Structure is also in the same race. But its move was more like another runner picking it up and carrying it across the finish line. Structure benefited from good clinical results from Eli Lilly and Company (LLY), showing that its new pill is good for diabetes management AND weight loss. JP Morgan noted that LLY's news should be very good for Structure Therapeutics, in the same field of development.

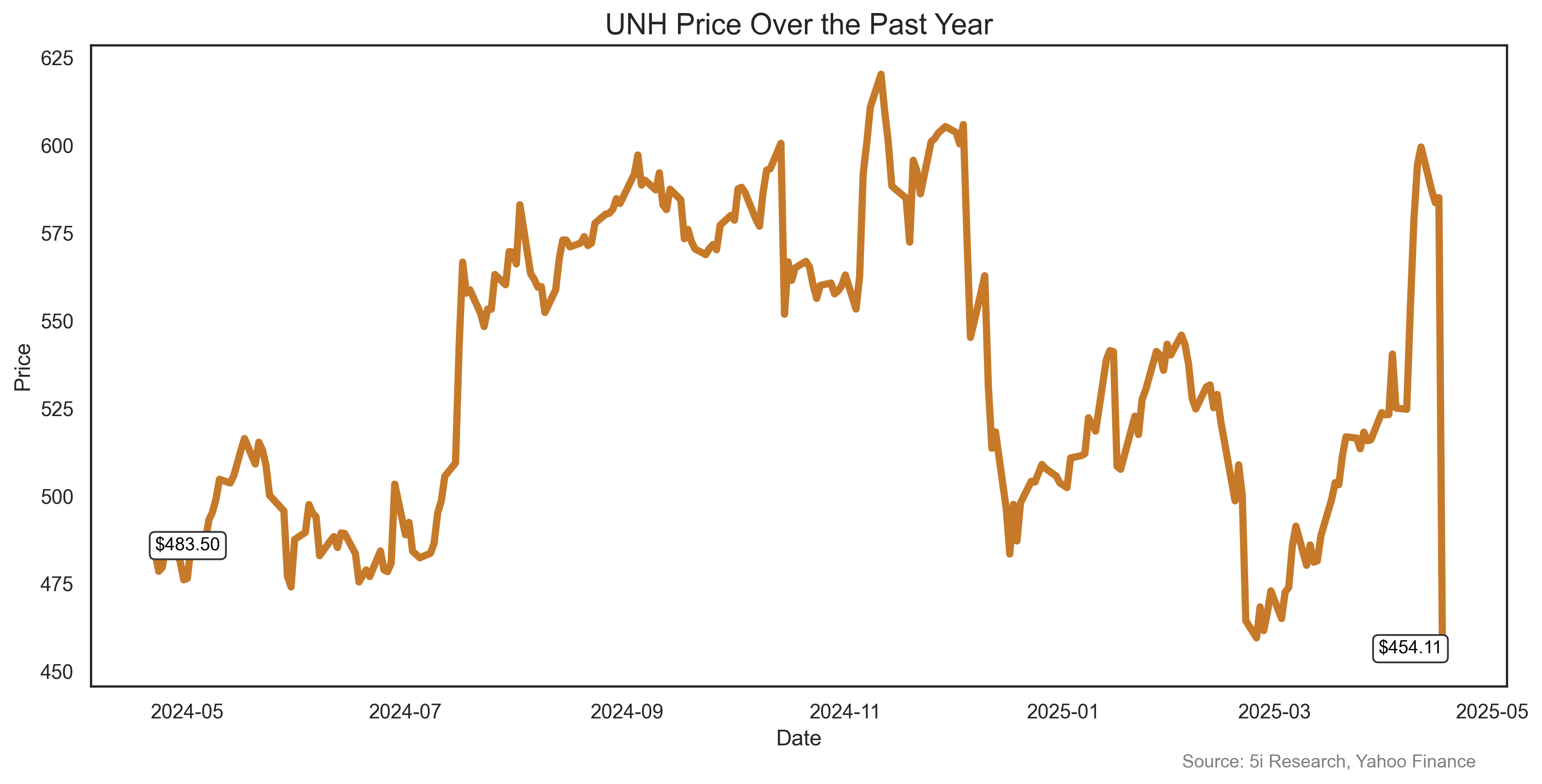

Usually, our rockets and duds list consists of smaller companies. These, of course, tend to be more volatile anyway. But this week we have a biggie: a company worth $415 billion (it was much higher a week ago) makes our DUDS list. For a company with 'health' right in its name, UNH sure has had a tough run recently. First, its CEO was assassinated in the street. Then, last week UNH announced an 'unusual and unacceptable' quarterly result, and lowered its guidance for the year. The stock fell 24%, wiping out close to $100 billion in value. Healthcare is supposed to be a good place to hide out in as the market tumbles all around you. The drop feels like a slap in the face for exhausted investors who now may need some healthcare of their own.

Usually, our rockets and duds list consists of smaller companies. These, of course, tend to be more volatile anyway. But this week we have a biggie: a company worth $415 billion (it was much higher a week ago) makes our DUDS list. For a company with 'health' right in its name, UNH sure has had a tough run recently. First, its CEO was assassinated in the street. Then, last week UNH announced an 'unusual and unacceptable' quarterly result, and lowered its guidance for the year. The stock fell 24%, wiping out close to $100 billion in value. Healthcare is supposed to be a good place to hide out in as the market tumbles all around you. The drop feels like a slap in the face for exhausted investors who now may need some healthcare of their own.

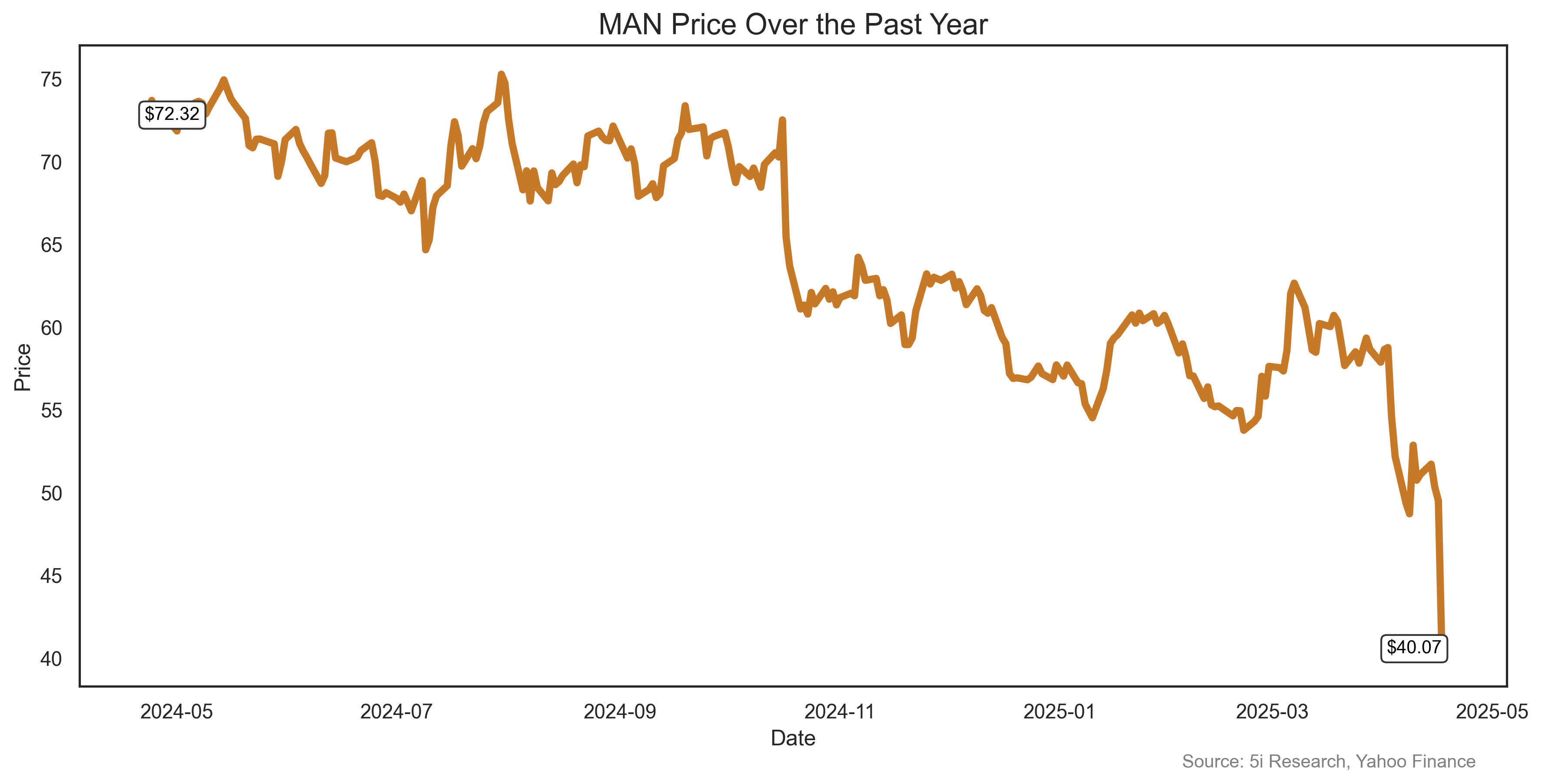

In a grim reflection of what's to come soon from other companies, Manpower lowered guidance last week and the stock fell 22%. It noted that clients for its employment agency services have adopted a 'wait and see' approach to hiring. This can hardly be a surprise, considering the tariff flippy flops of the past few months. Companies have no idea what's going on--of course they are going to not hire anyone for now. We think the US government needs to hire some first-year economics students: this is basic stuff, people!

In a grim reflection of what's to come soon from other companies, Manpower lowered guidance last week and the stock fell 22%. It noted that clients for its employment agency services have adopted a 'wait and see' approach to hiring. This can hardly be a surprise, considering the tariff flippy flops of the past few months. Companies have no idea what's going on--of course they are going to not hire anyone for now. We think the US government needs to hire some first-year economics students: this is basic stuff, people!

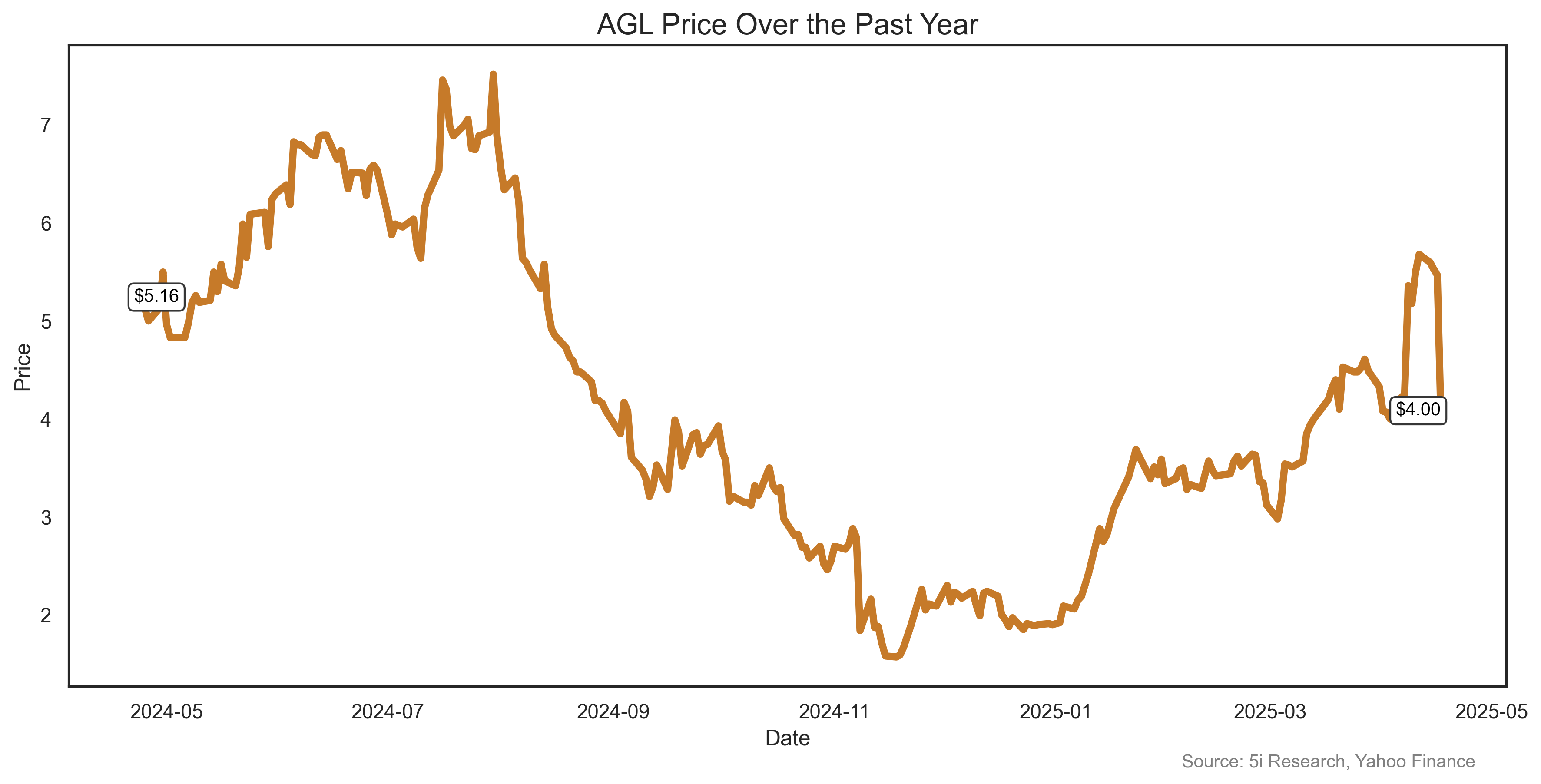

Unlike UNH above, agilon was having a stunning 2025, and remains up 110% for the year so far. But, then UNH had to go and ruin its party. Much smaller than UNH but also in the health care management industry, AGL fell 29% on the back of the UNH news. Its jump earlier in the year was largely related to increases in medicare payments. This was a rare 2025 case where the US government actually helped a company. It's too bad UNH had to go and spoil the party for agilon.

Unlike UNH above, agilon was having a stunning 2025, and remains up 110% for the year so far. But, then UNH had to go and ruin its party. Much smaller than UNH but also in the health care management industry, AGL fell 29% on the back of the UNH news. Its jump earlier in the year was largely related to increases in medicare payments. This was a rare 2025 case where the US government actually helped a company. It's too bad UNH had to go and spoil the party for agilon.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.