5i Research Weekly Rockets and Duds

This week's 5i Research Rockets

and Duds

and Duds

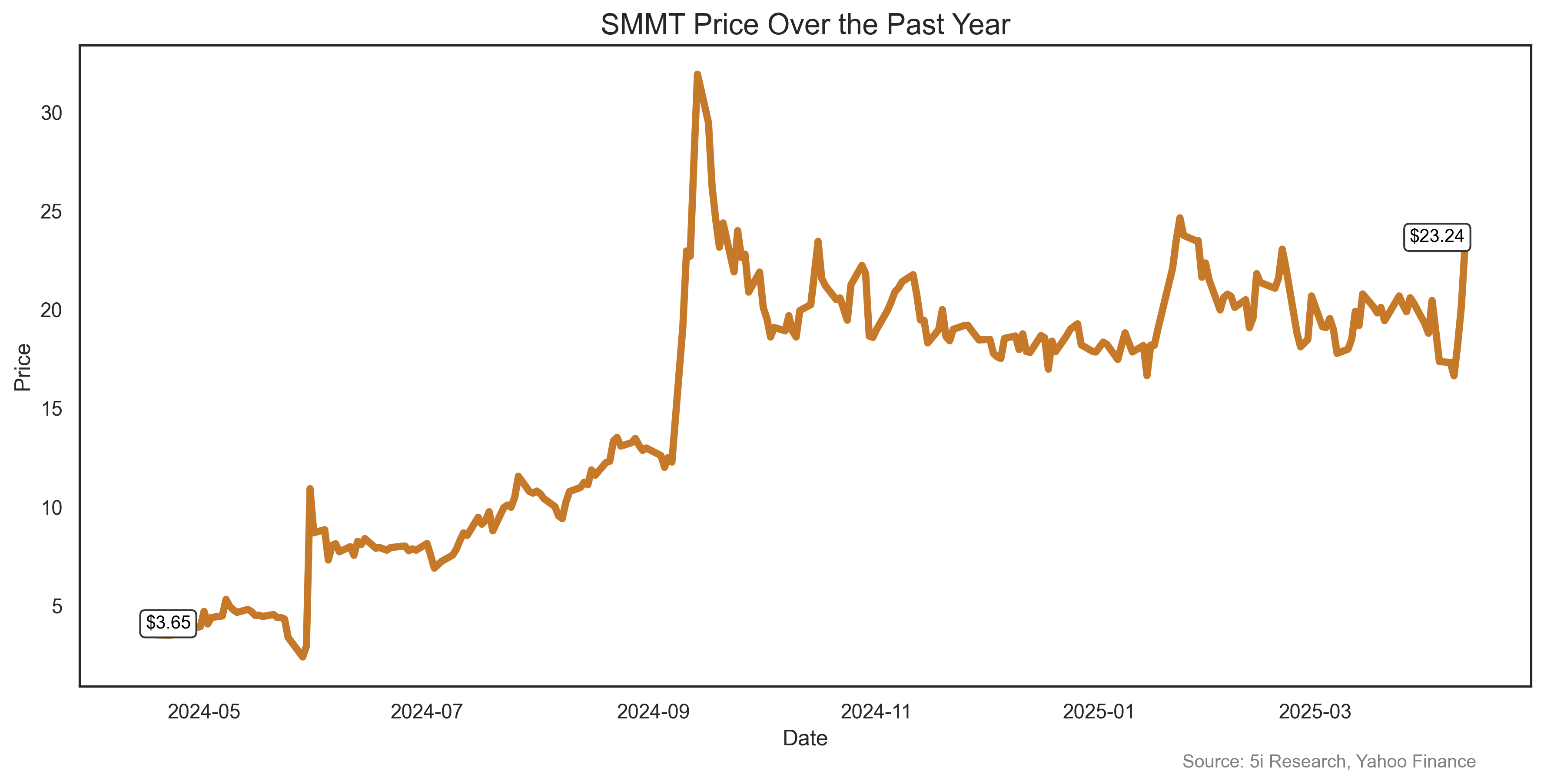

Buying a biotech stock just before clinical data is about the riskiest thing an investor can do. Stocks can soar, or crash, on clinical results. But, maybe it helps if the CEO buys first. Summit rose 34% last week on news that its CEO exercised options four years earlier than needed, and bought 3.9 million shares in the company. Investors are awaiting trial results on the company's non-small cell lung cancer treatment. The stock is now up more than 500% in the past year. Cantor also gave out bullish comments on the company last week.

Buying a biotech stock just before clinical data is about the riskiest thing an investor can do. Stocks can soar, or crash, on clinical results. But, maybe it helps if the CEO buys first. Summit rose 34% last week on news that its CEO exercised options four years earlier than needed, and bought 3.9 million shares in the company. Investors are awaiting trial results on the company's non-small cell lung cancer treatment. The stock is now up more than 500% in the past year. Cantor also gave out bullish comments on the company last week.

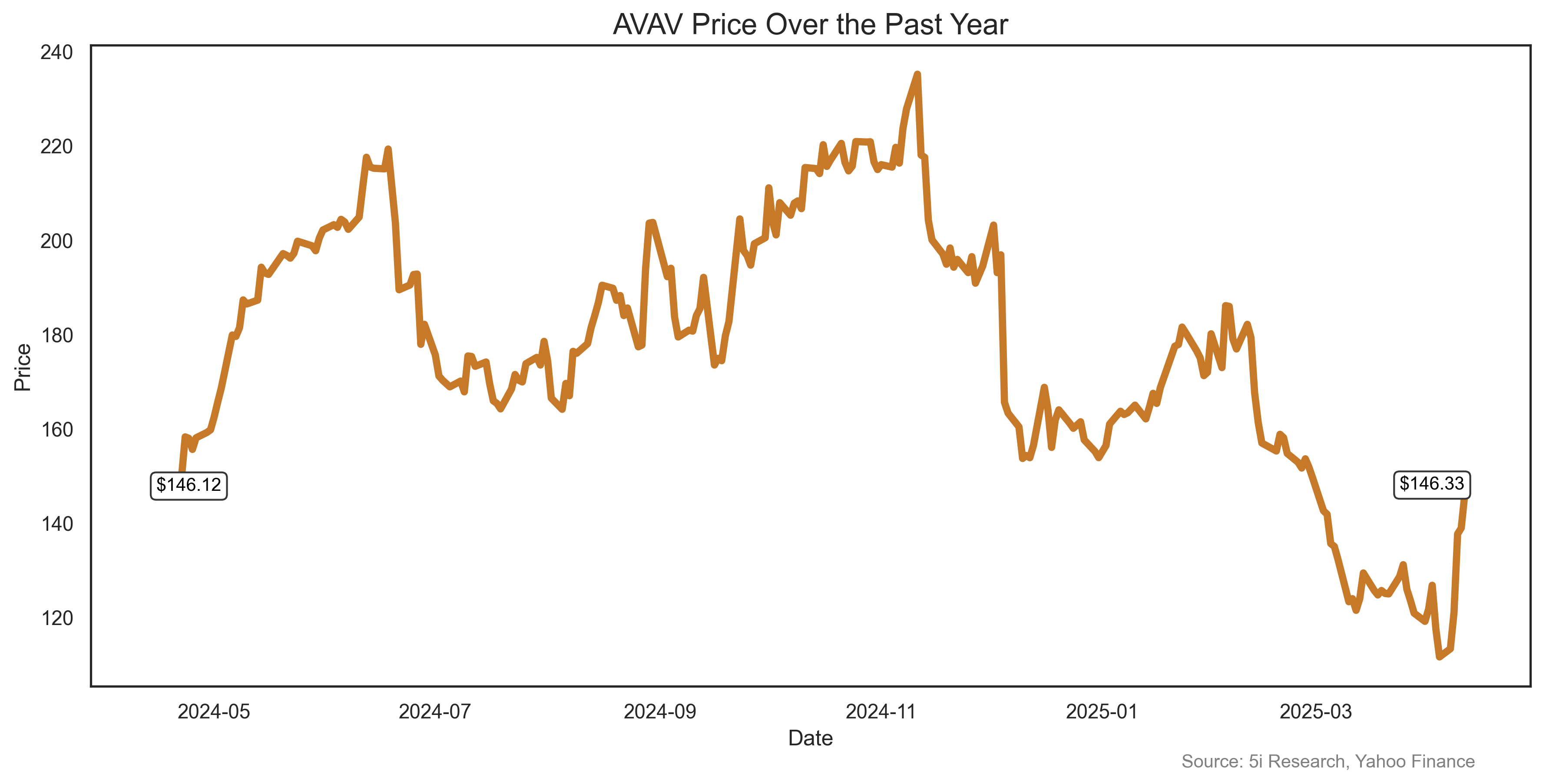

AVAV soared 31% last week, but there was no company news. Maybe, investors, not knowing if the market is a bargain or is about to crash, decided to invest in a 'war' company. Aerovironment is a leading drone manufacturer. Shares plunged earlier this year on weak results, but investors maybe just realized that the Ukraine War is in fact still ongoing.

AVAV soared 31% last week, but there was no company news. Maybe, investors, not knowing if the market is a bargain or is about to crash, decided to invest in a 'war' company. Aerovironment is a leading drone manufacturer. Shares plunged earlier this year on weak results, but investors maybe just realized that the Ukraine War is in fact still ongoing.

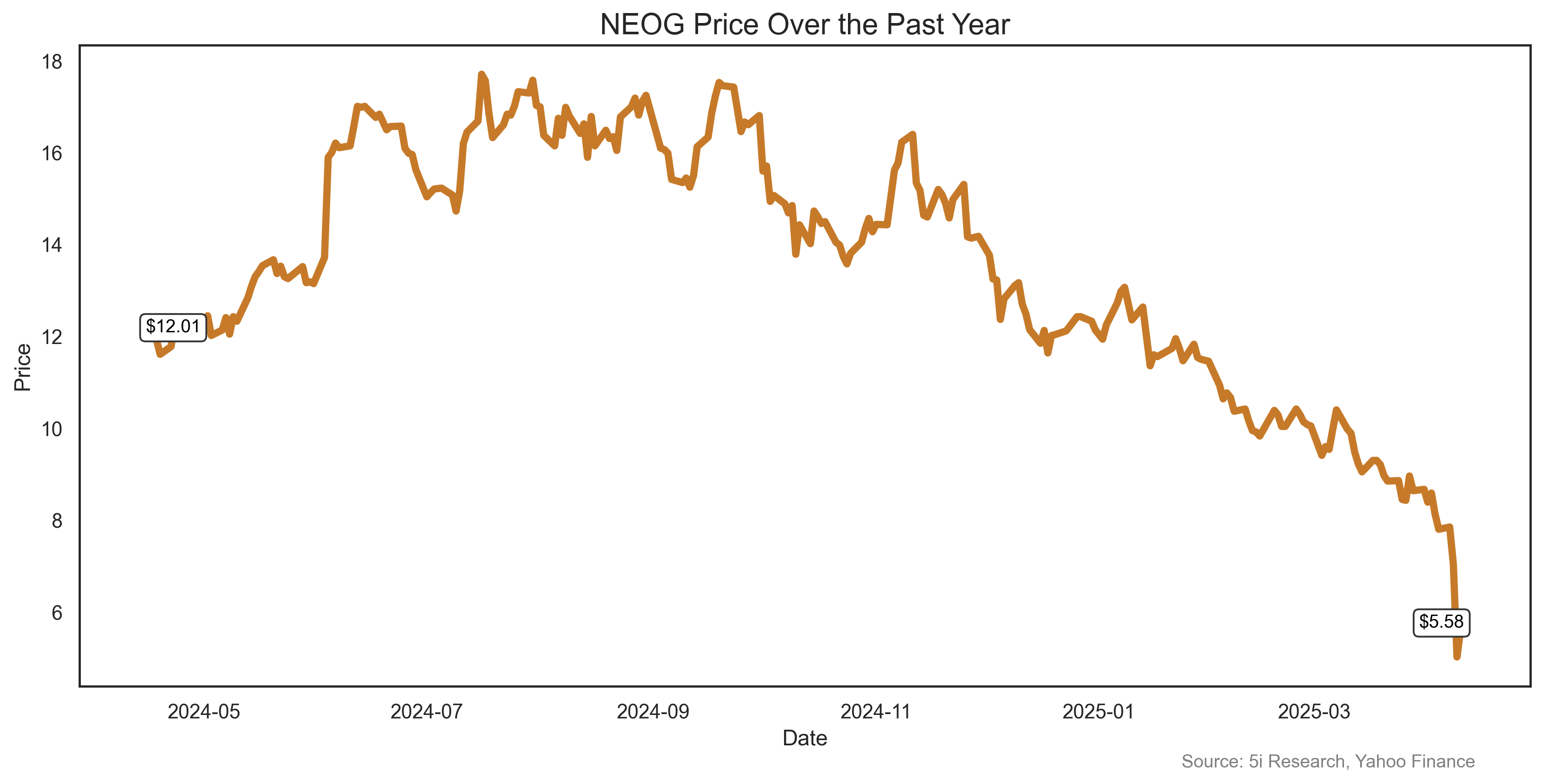

The food and animal safety company got a triple dose of bad news last week. First, the company reported weak results. Then, citing tariffs and other issues, it lowered guidance. Then, the company's long-time CEO decided to exit. The stock fell 29% and is now down 55% over the past year.

The food and animal safety company got a triple dose of bad news last week. First, the company reported weak results. Then, citing tariffs and other issues, it lowered guidance. Then, the company's long-time CEO decided to exit. The stock fell 29% and is now down 55% over the past year.

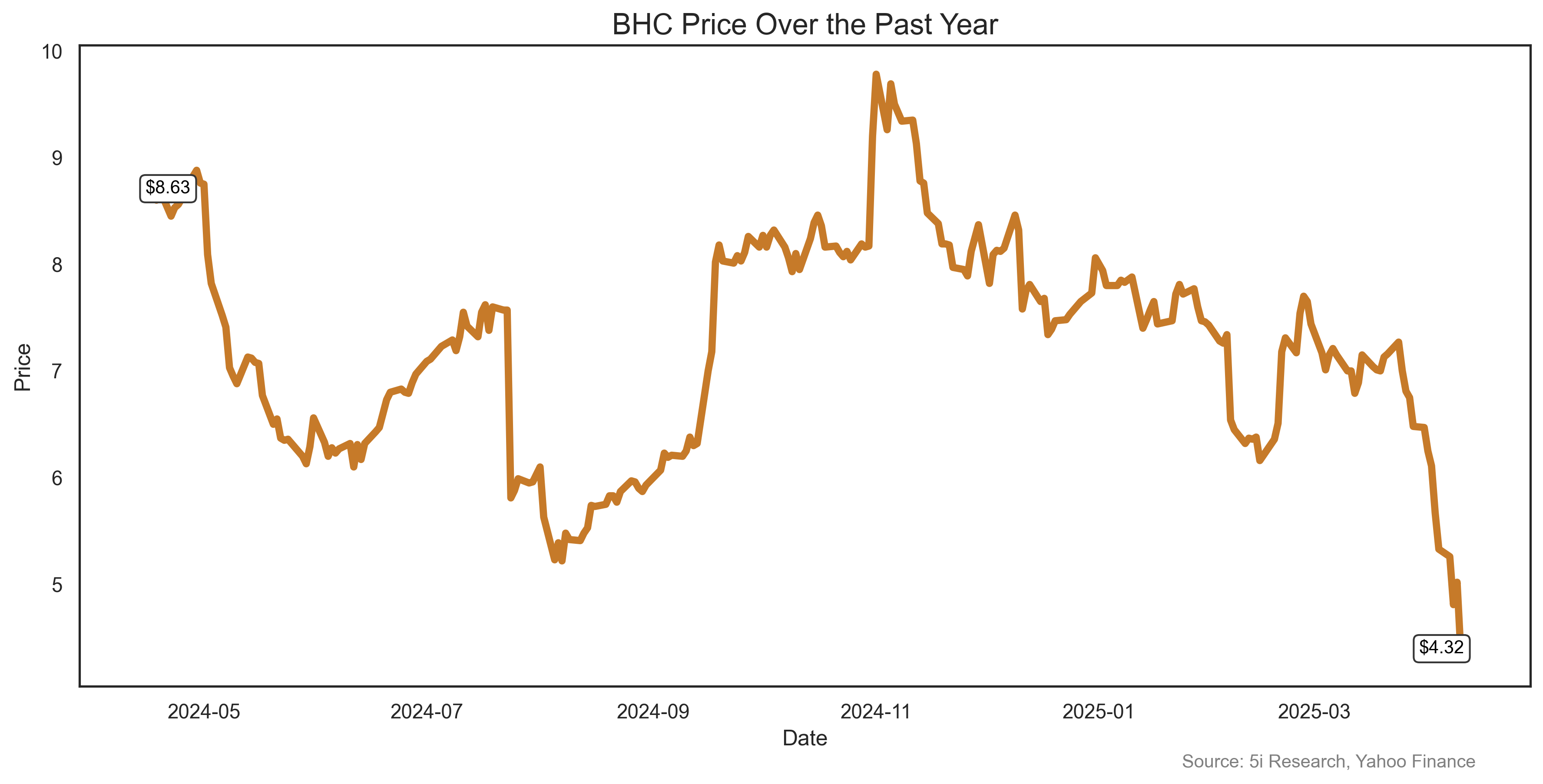

It's hard to believe this company, in a former life and iteration, was Canada's largest company. Market cap now is only $2.1 billion. That's just how it goes when you have a 10-year stock performance of negative 98%. BHC fell 21% last week as it sold $4.4 billion in notes and had a product recall. Debt is an issue here, and it is not the type of market for risky former-darling companies.

It's hard to believe this company, in a former life and iteration, was Canada's largest company. Market cap now is only $2.1 billion. That's just how it goes when you have a 10-year stock performance of negative 98%. BHC fell 21% last week as it sold $4.4 billion in notes and had a product recall. Debt is an issue here, and it is not the type of market for risky former-darling companies.

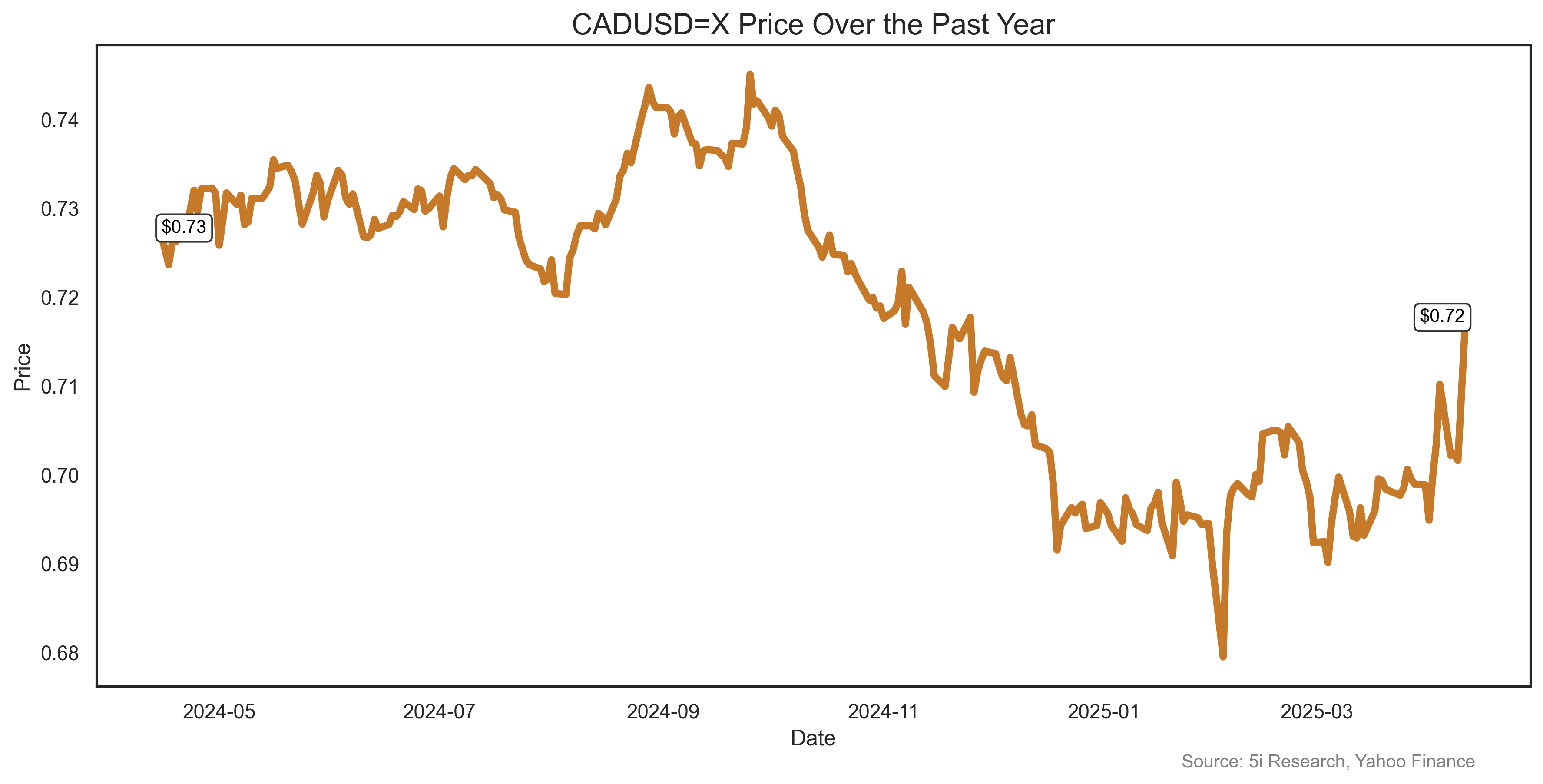

Let's see, Canada is getting hit with tariffs. Oil is plunging. Alberta is threatening to separate from Canada. These hardly sound like ideal conditions for a big rally in the Loonie. But our dollar rose 2.4% last week despite a weak economy, political uncertainty and the aforementioned factors. But it's not so much that everyone likes the Loonie. This is more of a case of no one wanting the US dollar right now. It's like being asked to the prom as the second choice.

Let's see, Canada is getting hit with tariffs. Oil is plunging. Alberta is threatening to separate from Canada. These hardly sound like ideal conditions for a big rally in the Loonie. But our dollar rose 2.4% last week despite a weak economy, political uncertainty and the aforementioned factors. But it's not so much that everyone likes the Loonie. This is more of a case of no one wanting the US dollar right now. It's like being asked to the prom as the second choice.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.