5i Research Weekly Rockets and Duds

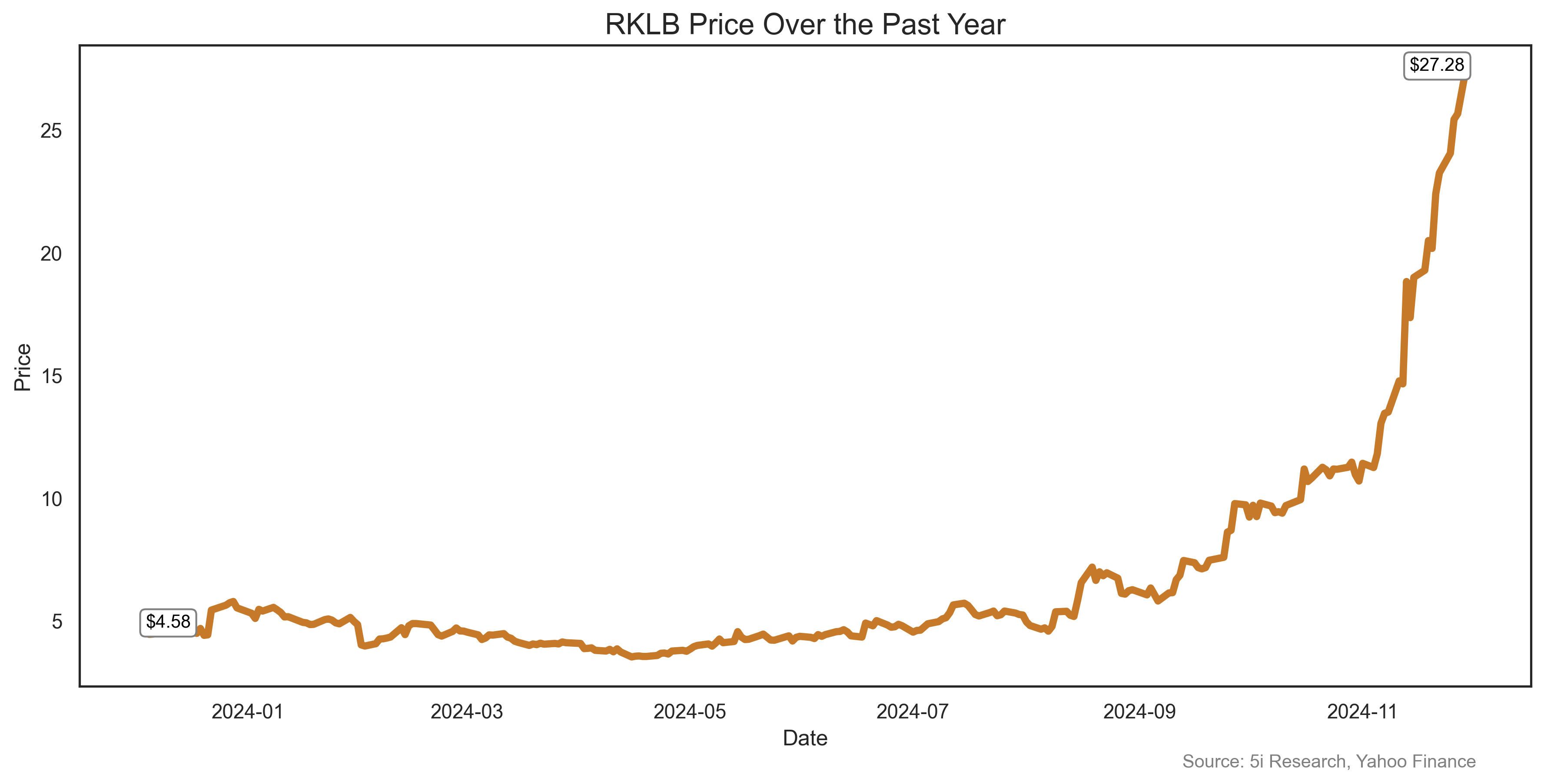

Certainly, an appropriate stock for our inaugural 'Rocket' category. RKLB surged 17% last week, taking its market cap to nearly $14 billion. Talk about a rocket: the stock is now up 393% so far in 2024. Excitement came as the company completed two launch missions--in both hemispheres--within 24 hours last week. Since Space X is still a private company, it looks like many investors are looking for alternative 'to the moon' stocks.

Certainly, an appropriate stock for our inaugural 'Rocket' category. RKLB surged 17% last week, taking its market cap to nearly $14 billion. Talk about a rocket: the stock is now up 393% so far in 2024. Excitement came as the company completed two launch missions--in both hemispheres--within 24 hours last week. Since Space X is still a private company, it looks like many investors are looking for alternative 'to the moon' stocks.

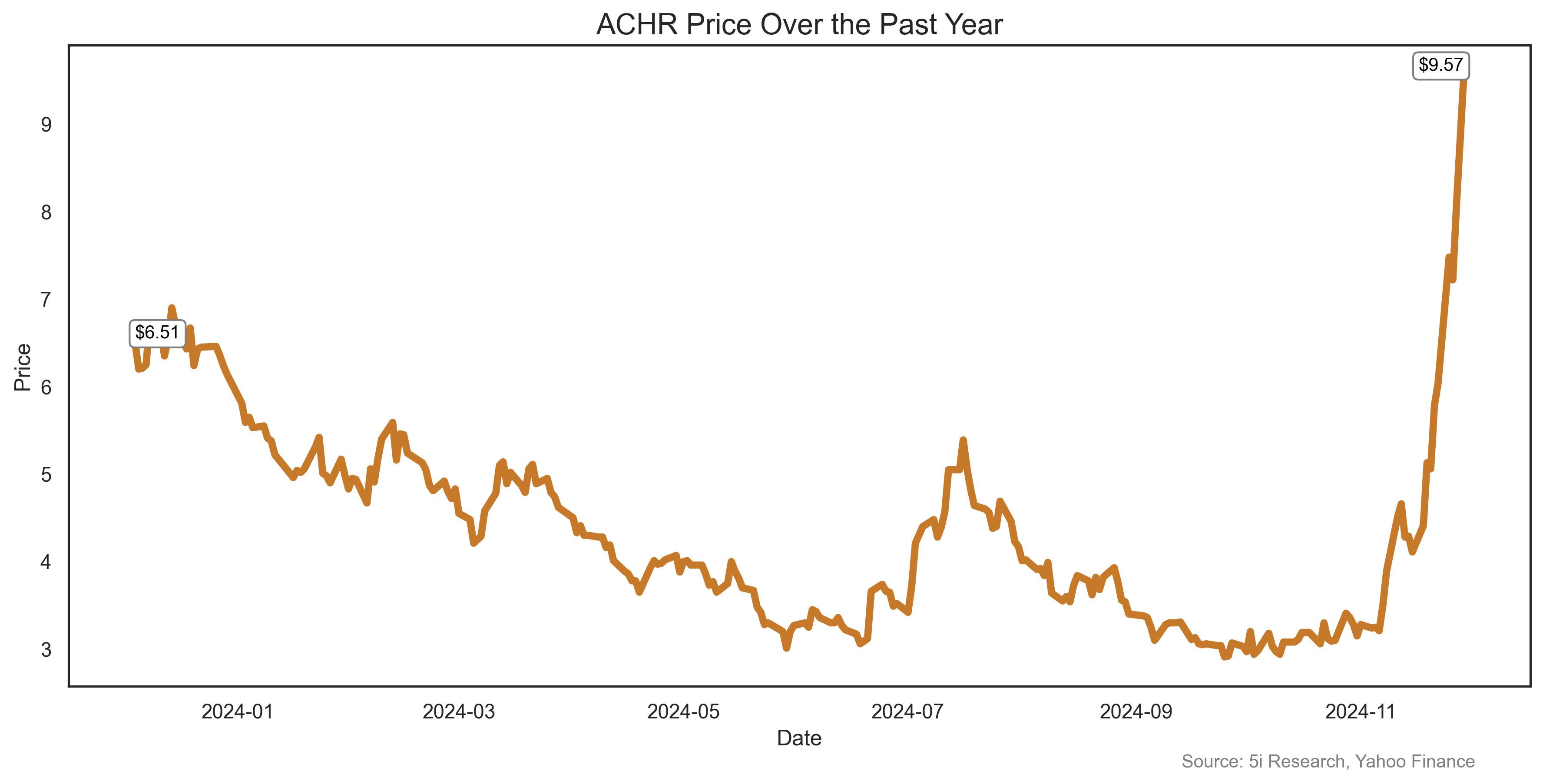

You could say this one was 'flying' last week. Archer, a $4 billion company with no operational revenue yet, rose 58% last week. Archer, which is developing electric vertical take-off and landing (eVTOL) aircraft, surged on news it had received $50 million in new funding from Mudrick Capital Management. Investors don't seem to care that eVTOL approval from the FAA isn't expected for at least a few years, they want in on this nascent industry now. The stock is still 'hovering' at half the levels it achieved in 2021, however.

You could say this one was 'flying' last week. Archer, a $4 billion company with no operational revenue yet, rose 58% last week. Archer, which is developing electric vertical take-off and landing (eVTOL) aircraft, surged on news it had received $50 million in new funding from Mudrick Capital Management. Investors don't seem to care that eVTOL approval from the FAA isn't expected for at least a few years, they want in on this nascent industry now. The stock is still 'hovering' at half the levels it achieved in 2021, however.

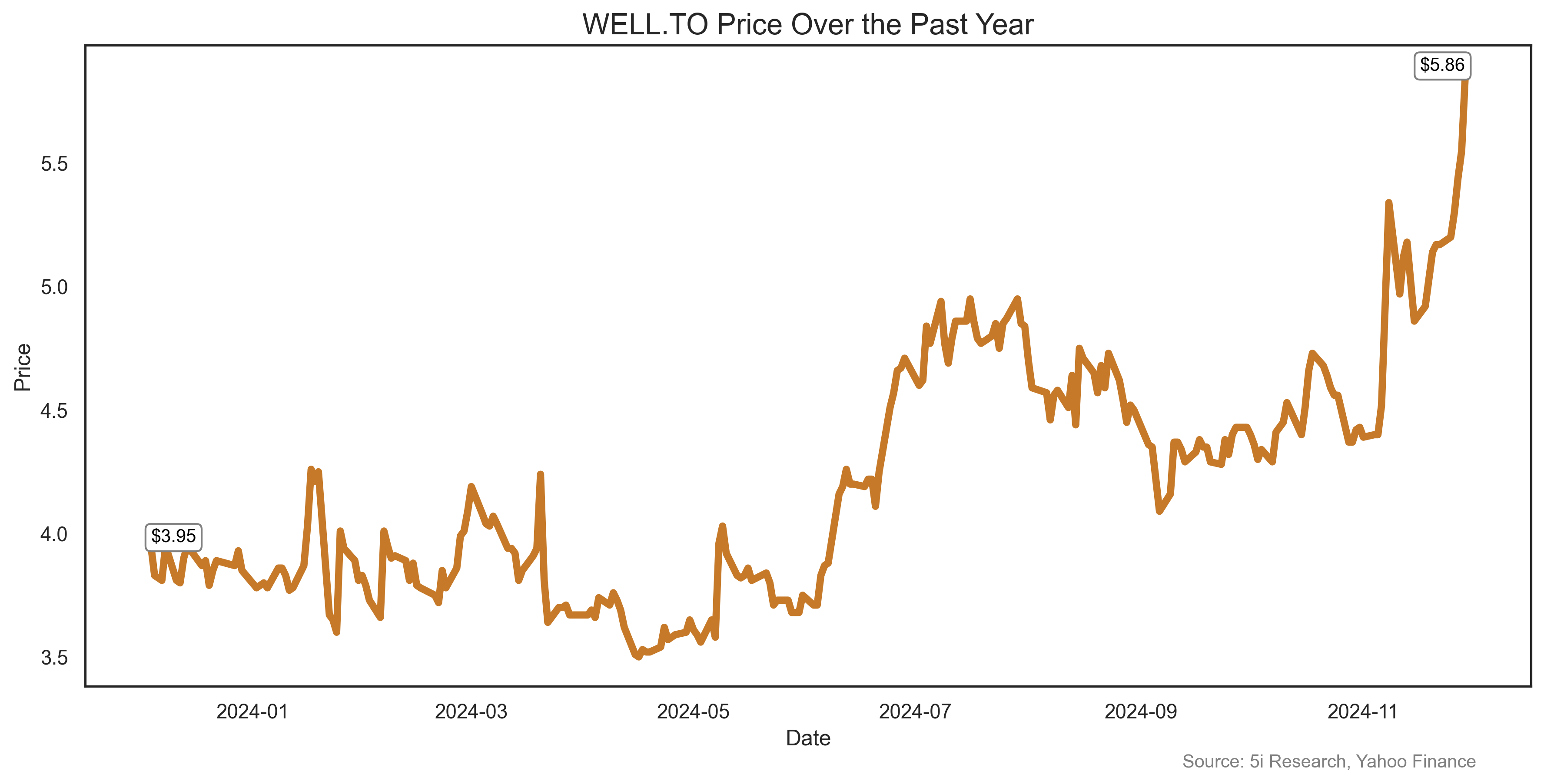

WELL, an operator of healthcare facilities and provider of software for the digitization of the healthcare sector, rose 13% last week. There was no specific news, but small cap stocks had a fabulous month in November, and WELL moved even though the Trump victory has scared many in the healthcare sector, with rhetoric of lower drug prices and other potential negative policy moves. We all know the healthcare sector could use some 'fixing' and it is good to see investors start to appreciate WELL for its growth within the sector. 5i Research Members can see our report on the company here.

WELL, an operator of healthcare facilities and provider of software for the digitization of the healthcare sector, rose 13% last week. There was no specific news, but small cap stocks had a fabulous month in November, and WELL moved even though the Trump victory has scared many in the healthcare sector, with rhetoric of lower drug prices and other potential negative policy moves. We all know the healthcare sector could use some 'fixing' and it is good to see investors start to appreciate WELL for its growth within the sector. 5i Research Members can see our report on the company here.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Comments

Login to post a comment.