Happy Father's Day!

This year give Dad the gift of knowledge for not only their future but their family's future. The markets have been declining so far this year and historically there has been no better time to invest in the markets.

Link here!

Report Updates

We have posted report updates on WSP Global (WSP) and Descartes Systems Group (DSG). WSP is one of the world's leading professional services firms, with a diversified set of global operations and DSG is a technology company that employs software and a global network to simplify complex business processes across the supply chain. Both are well-managed and diversified businesses that have a solid financial foundation. One is an extremely adaptive company that benefits from dynamic economic environments and the other continues to acquire businesses and expand its EBITDA margins. We feel that both are names to keep a close eye on.

Read the latest updates by logging in here!

Market Update

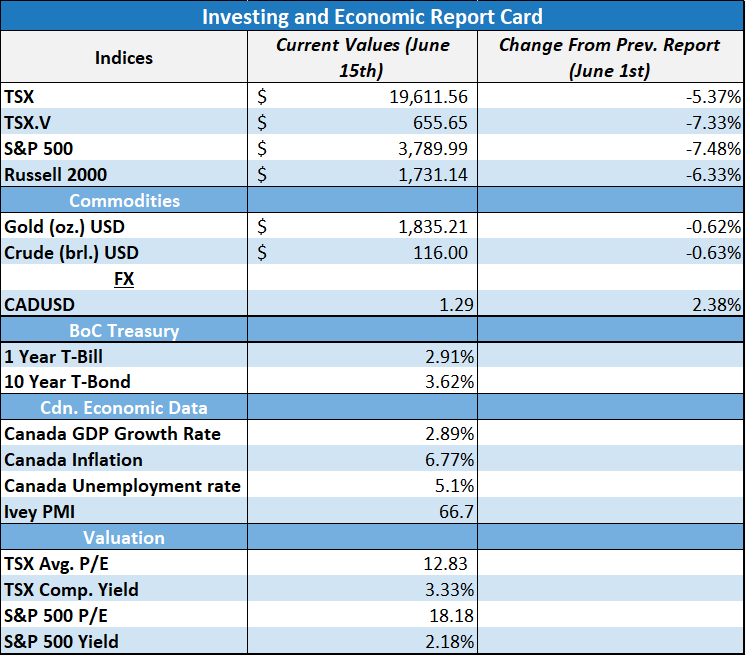

The markets have hit new 52-week lows over the past couple of weeks, and growing fears of recession, persistently elevated inflation, and economic headwinds from rising rates are putting a damper on market conditions. The Federal Reserve hiked interest rates by 75 basis points this past Wednesday, bringing the range to 1.5% to 1.75%, and signaled that they intend to raise rates above 2.0% by the end of the year. Higher rates are designed to bring inflation down, and while inflation is largely dependent on demand (influenced by interest rates), there are also other forces in the commodities space that we are currently seeing.

The Rise and Rise of Commodity Prices

By now, all of us have likely heard of the rising energy prices, rising commodities prices, and each one’s impact down the production chain on inflation. In this market update, we want to explore some of the more specific reasons why each commodity is rising in price and how some of these constraints might be eased.

Below we have outlined some of the largest commodity gainers over the past year, and each one’s cumulative gain. We can immediately see the rapid rise in natural gas prices and the jump in the price of coal. Alongside coal and natural gas’ big price increases are a steady rise in wheat, corn, cotton, soybeans, oil, and aluminum. Natural gas increased almost four-fold, coal roughly three times, and the other commodities ranging from a 7% to 72% annual increase.

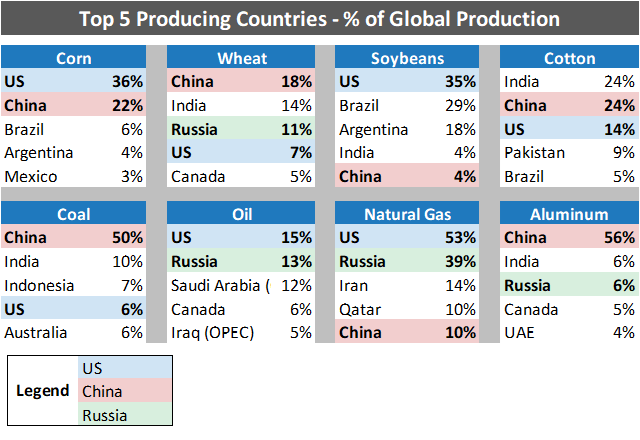

We will be reviewing the major forces at hand that are impacting commodities prices, but the main three forces that we have seen across rising commodities prices are adverse weather conditions (drought), the Russia-Ukraine conflict, and concentrated country risk. Below we have summarized the top five producing countries for eight different commodities and each country’s percentage of global production. We have specifically outlined China, the US, and Russia as at least two of these countries are always present in the top five producing countries for each commodity and represent the highest single points of failure across the commodities space.

Source: atlasbig.com, Wikipedia.org, worldpopulationreview.com, nsenergybusiness.com

Corn

Corn has seen a rise in price since the beginning of 2022, and this is largely attributable to droughts across the Western US. The United States is the largest global corn producer, with 36% of global production, followed by China at 22% of global production. Many farmers in the US were unable to plant during the peak corn planting period, and as a result, there is an expectation for farmers to forego planting this year and instead will take prevent-planting insurance payments.

Soybeans

The single largest global producer of soybeans is the US, but Brazil, Argentina, and Paraguay make up for more than half of the world’s soybean production. Since late 2021 there has been a drought across the southern part of Brazil, disrupting the world’s second-largest soybean producer’s planting.

Cotton

China and the US make up a large part of the world’s cotton production, with China representing 24% of global production and the US at 14%. West Texas, which is one of the larger cotton-producing areas of the world, faced a drought that has negatively impacted its cotton production. Alongside drought conditions in the US, farmers are beginning to plant other products that have seen even larger price increases (soybeans, corn, etc). This has caused increased supply shortages of cotton.

Wheat

China is the largest producer of wheat in the world, but Russia represents 11% of global production, but sanctions on Russia have severely impacted the global supply of wheat. In addition, Russia and Ukraine account for almost one-third of the world’s wheat exports (not production), and Ukraine’s supply chain has been significantly disrupted by the war, exacerbating shortages.

Coal

China represents roughly half of the world’s coal production, and coal has been considered a less-environmentally friendly source of energy for some time now, but there has been a slight resurgence in the use of coal, which is outstripping the supply. Lack of infrastructure and investment for coal production and China representing a large piece of global production has led to supply constraints.

Oil and Natural Gas

The US is experiencing extreme heat and power generators require gas to produce electricity. In conjunction with the rise in temperature requiring natural gas, Russia is the world’s second-largest producer of natural gas, and sanctions have disrupted the typical supply to nearby nations. Russia is once again the world’s second-largest producer of oil and the sanctions imposed have impacted the oil supply to other nations.

Impact on Inflation

Looking at all these commodity price increases over the past year against the rise in inflation begins to paint a clearer picture of some of the contributing factors to high inflation. In the chart below, in green, we have the US inflation print against all the commodities mentioned above (in grey).

The initial commodities spike in the fall of 2021 helped to contribute to a higher inflation print, and subsequently rising commodity prices over the winter and spring as war, droughts, and extended COVID lockdowns contributed to a further rise in commodity prices and inflation.

Commodity prices saw a rapid rise in March at the onset of the Russia-Ukraine war, and since then we have actually seen certain commodities falling. Coal is down almost 28% since early March, wheat has seen almost a 12% decline, aluminum is down 23%, and oil is down ~2%. The most notable exception is natural gas, and this has played a big role in sending inflation higher.

Where Do We Go From Here?

We now know that three major factors are impacting commodity prices and thus inflation – concentrated country risk, the Russia-Ukraine war, and severe droughts throughout North and South America. Looking at commodity prices since March of 2022 shows us that most commodities are relatively flat, except for natural gas, and we believe that these factors will likely lead to a flat or increasing inflation print for June and July.

Certainly, any easing of the Russia-Ukraine conflict will bring certain commodity prices down, which will act as a net positive for inflation. The droughts that have brought supply issues to commodities like corn, soybeans, and cotton have mostly run their course so far, and free-market economics are playing their role with farmers reallocating farmland to more lucrative crops. The extended lockdown measures in China, representing concentrated country risk, can only impact commodity prices for so long until either China eases its policies or other countries begin to see opportunity and increase their infrastructure investments in aluminum, coal, and cotton production. We believe it may take some time for these factors to play out, but there is an endgame to all of these negative contributing forces and for now, we wait for the next shoe to drop.

Best wishes for your investing!

www.5iresearch.ca