New Report

We have posted a new report on Richelieu Hardware (RCH). RCH is a leading importer, distributor, and manufacturer of specialized hardware and related products in North America. RCH has established itself as a market leader in the specialty hardware distribution space across North America through continuous successful acquisitions and integrations. With RCH's long history of acquisitions and the expanding renovation industry, we believe that this name is worth taking a closer look at.

Read the latest updates by logging in here!

Report Updates

We have posted report updates on Andrew Peller (ADW.A) and Stella-Jones (SJ). SJ is North America's leading producer of pressure-treated wood products, supplying essential materials to the utility, telecommunication, and railroad industries. ADW.A is a manufacturer of premium wines and craft beverage alcoholic drinks in Canada. The company has a portfolio of strong brand names and an extensive distribution network with retailers across Canada. One company has demonstrated remarkable resilience, even during the volatile commodities market, while the other has been negatively impacted by an ineffective cost structure and inefficient operations. We think both reports provide valuable insights into the operations across different industries.

Read the latest updates by logging in here!

Investor Sentiment Survey

Thank you to all of those that have participated in our investor sentiment surveys thus far. We feel that these surveys have added value to our thought process on the current investment landscape, and we hope that you all have felt the same.

The survey shouldn't take more than 5 minutes and no personal details are required.

Let us know how you are feeling about markets and the economy by following the link below! We will let you know the results in our next market update.

Investor Sentiment Survey

Market Update

The markets have mostly been moving lower or flat over the past few weeks as traders digest company earnings and macroeconomic data. There have been concerns over the health of US regional banks in the past few weeks as issues continue to arise and the sale of assets and takeovers occur. The Federal Reserve's recent 25 basis point hike and indication for a potential pause has provided some comfort to the markets. Oil prices have ticked up after experiencing a significant decline of over 8% this week. The US dollar remains under pressure, and gold has hit an all-time high. In this market update, we aim to uncover the connection between company earnings and the stock market, and whether a decline in corporate earnings has been priced in.

Earnings Decline Fears

The stock market is facing a lot of criticism over concerns of a potential recession, growth slowdown, and other economic uncertainties that continue to impact the global economy. One of the recent major concerns for investors has been the potential for declining company earnings, which could weigh on stock prices and hinder the overall performance of the stock market. However, the question remains: how much of these fears of earnings declines have already been priced into the markets?

Has the Market Priced in the Potential for an Earnings Decline?

What we can see is that largely, over time, the market (blue line) and corporate profits (orange line) tend to follow each other. There are several instances where corporate profits decline first and then the market follows (late 1990s), or the market falls first and then corporate profits decline (March 2020).

Recently, we have seen the market correct throughout 2022 as earnings stagnated. What this signals to us is that the market anticipated a fall in earnings as inflation and rising interest rate headwinds would take hold, however, earnings merely flatlined. Further earnings contraction from here is certainly possible, but we feel that the market declines have already priced in this possibility.

Corporate Profits and Market Divergence

Switching gears to an alternative viewpoint of the same data, the below chart highlights the year-over-year percentage change in US corporate profits (black line) and the S&P 500 (blue area). What we can see is a general trend emerge as year-over-year changes in profits largely correlate with a similar percentage change in the markets.

One major divergence we have noted is the most recently, where the markets declined as much as 20% on a rolling one-year basis, whereas US earnings were actually up about 5% on a rolling one-year basis. This means that the annual change in the markets of (20%) signalled a large mismatch with earnings.

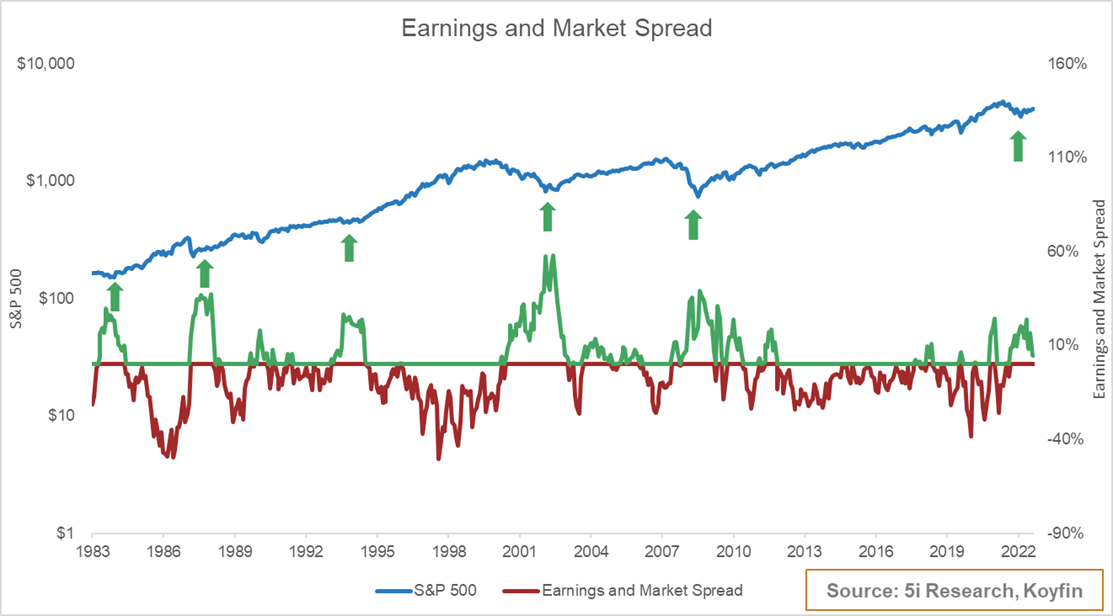

Annual Earnings and Market Changes - Spread

The spread between the annual change in US corporate earnings and the market is interesting to note, and we have charted the spread in the graph below. When the spread between the one-year percentage change in earnings and the one-year percentage change in the market is above 0 (green), it means that earnings grew faster than the market. When the spread is negative (red), it means that earnings grew slower than the market.

Overlaying a chart of the S&P 500 since 1983 shows that whenever the spread was green and it peaked, this typically signaled a market bottom, whereas areas of red indicated a market that was becoming overheated and growing faster than earnings. Based on a good track record from this indicator, it seems as though the market has effectively discounted in any potential earnings decline, and in fact, the lack of earnings decline has placed the market in an ‘undervalued’ zone in our opinion.

What we have demonstrated through these series of charts is that the lack of a material decline in earnings has effectively made the S&P 500’s valuation more attractive, as a marginally growing corporate earnings of ~5% has outweighed a large decline in the S&P 500 of (~20%). As earnings season continues to progress, we are increasingly encouraged by companies’ earnings and resiliency through these challenging times, and this in our view provides a bull case for increasing momentum in the stock market throughout the rest of the year and into 2024.

Best wishes for your investing!

www.5iresearch.ca