Spending on AI infrastructure is growing rapidly, and the need for AI workloads is not appearing to slowdown anytime soon. This has led to a boon in AI-related plays, and even industrial companies that traditionally have not been tightly correlated with high-tech, but are now seeing demand for AI infrastructure. When looking for Canadian stocks that are in the AI space, the company set is fairly limited, and often a ‘derivative’ play. Nevertheless, the below list of companies are names that have directly benefited from an increased spending and demand for AI infrastructure.

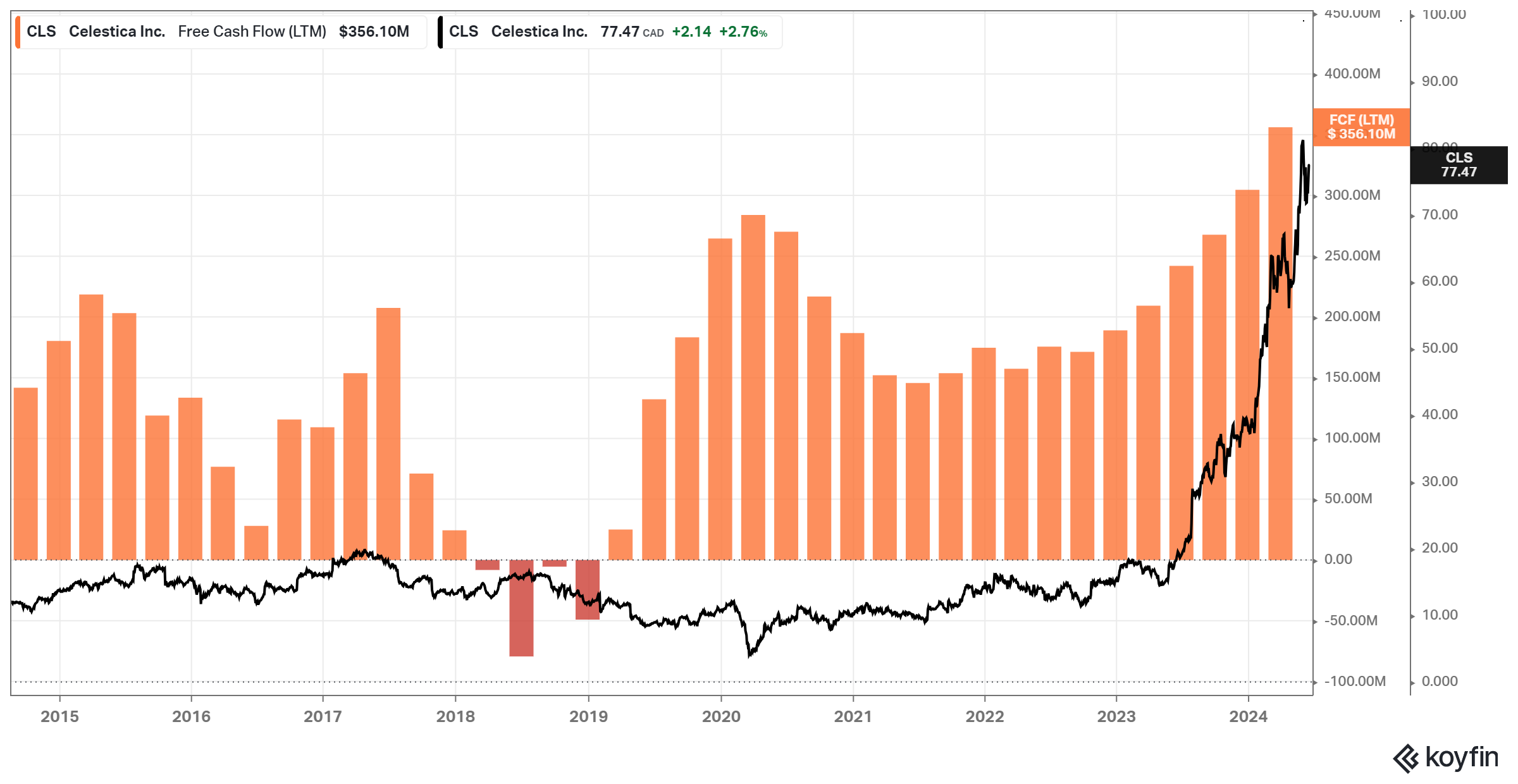

CLS can be considered a tech manufacturer. While this is a very simplified explanation of its services, its services range from the design and engineering of electronic components to manufacturing specialized machine tool technology for companies. It can create these components for customers in the semiconductor, healthcare, industrial, aerospace and defense, and smart energy industries. Overall, it is much less involved in the software side of things, and more so on the hardware and manufacturing of electronic components. We like CLS for its exposure to cloud solutions and AI-infrastructure space, and management has done an excellent job of controlling costs and expanding its free cash flow.

GIB.A is a leading global IT consulting company based in Montreal, and it largely provides business and strategic IT consulting, systems integration, and software solutions. In mid-2023, the company announced a planned investment of $1 billion over the following three years to support the expansion of its AI services. These investment plans include the expansion of its AI-related consulting services, intellectual property-AI enablement, global employee hiring and training, and operational excellence efficiencies. In late 2023, it expanded its partnership with Google to leverage Google Cloud and enhance the capabilities of its CGI PulseAI solution platform. Management noted in its most recent earnings that almost 80% of its clients are actively exploring AI technology.

KXS is a global leader in supply chain management, and it uses AI to build intelligent supply chains for more than 40,000 users. Its patent portfolio has grown by more than fivefold and 55% of its portfolio is for AI and machine learning capabilities. It uses AI to generate prescriptive recommendations, predict insights, automate processes and enhance productivity on its platform. Its AI tools assist KXS’ clients with demand forecasting, inventory optimization, and capacity planning.

OTEX is a global leader in information management, and it has an AI-specific platform called opentex.ai, its new vision and direction for AI. This platform can allow its customers to solve complex problems by using AI and Large Language Models (LLM) with OTEX software. It also has OpenText Aviator Private Cloud, which is a new managed services offering to host and manage private LLM data and models for its private cloud customers.

DCBO is a leading learning platform provider, and in mid-2023, it acquired Edugo.AI, a generative-AI (GenAI) learning technology that can help its clients optimize learning paths and adapt to the individual learners needs. DCBO also plans on introducing new capabilities to provide solution-specific AI simulations, allowing learners on its platform to practice soft skills with real-time AI feedback. DCBO has a partnership with Google Cloud to improve its ability to train enterprise workforces, customers, and external communities with GenAI technology.

CVO is a leading enterprise AI platform that brings AI search and GenAI to many different points-of-experience. This is a small-cap name ($815 million market cap), but it is one of the only ‘pure’ AI plays currently in the Canadian markets. These points-of-experience that CVO aims to optimize include commerce, service, website, and workplace applications. It has ‘Smart Snippets’ which use machine learning and LLMs to provide fast and direct answers to users’ searching. Management noted that over 70% of its customers are expecting GenAI to enhance their online shopping experience.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Research for Today, Invest for Tomorrow.

Twitter: @5iChris

Disclosure: The analyst(s) responsible for this report do not have a financial or other interest in the securities mentioned.

Comments

Login to post a comment.