In this edition of ‘Stock Teasers’, we are going to be looking at Canadian stock outliers using a unique screener in each edition. The screeners have two main variables, of which will change each time, and the end goal is to find a group of stock outliers on the graph and identify why they might be outliers.

Canadian Stock Outlier Screener

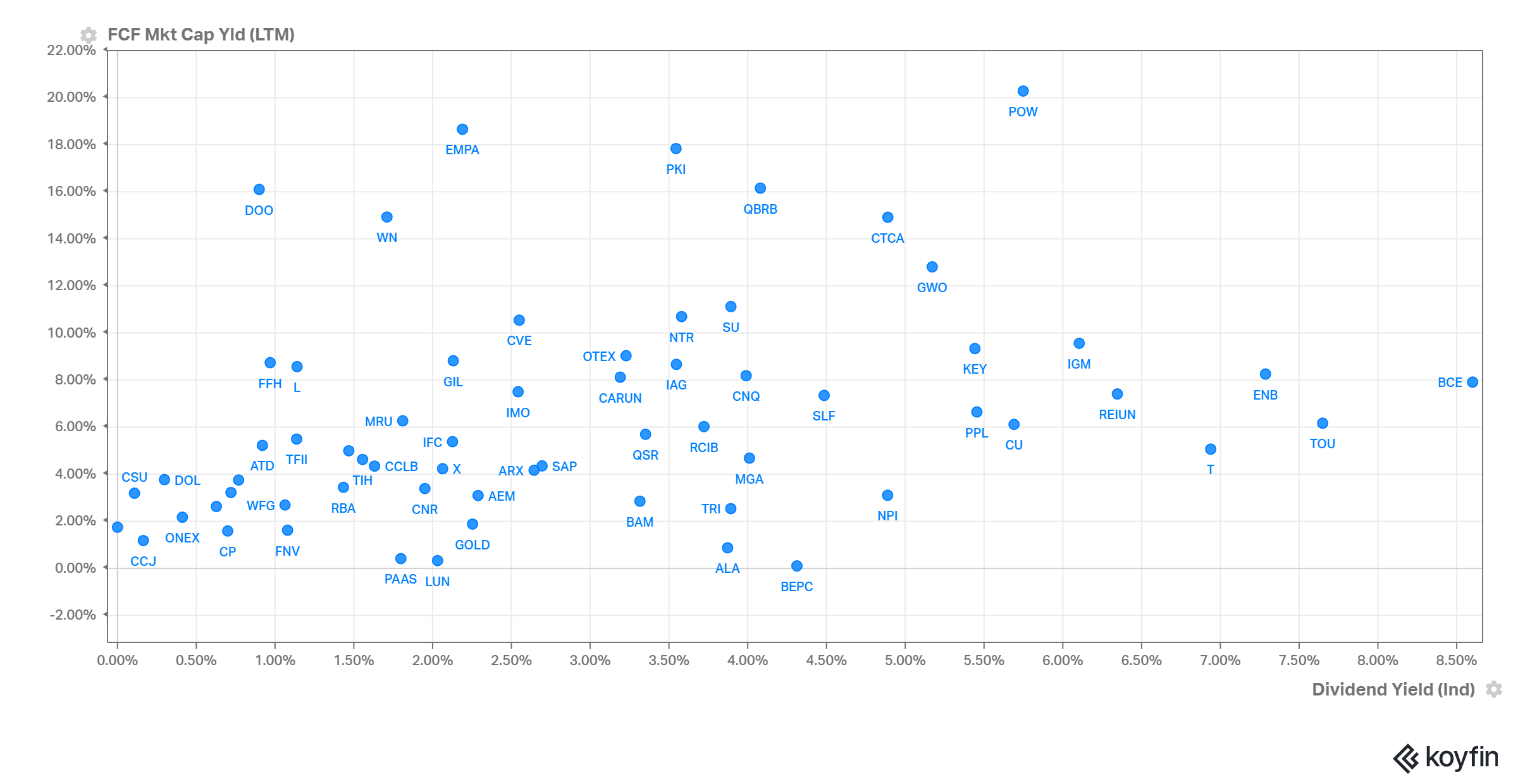

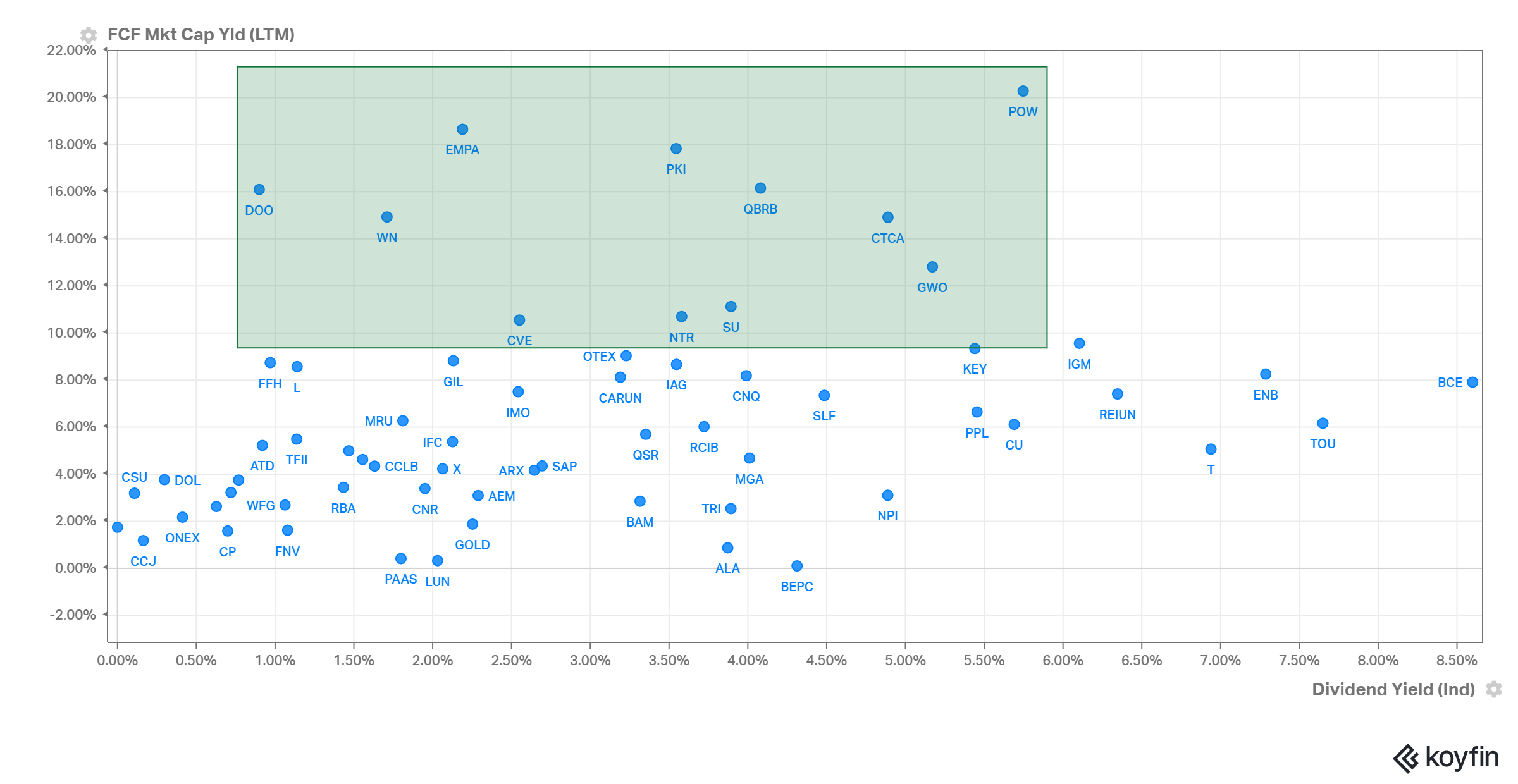

We have used the following variables across the Canadian stock universe: free cash flow and dividend yield. Combining these two variables give investors a good idea of which stocks currently have a high ability to service their dividend yields. Looking along the bottom axis we can see which Canadian stocks are paying high dividend yields (further to the right), and on the left axis, we can determine who has the best ability to service these dividend yields (furthest to the top).

We have outlined a set of stocks below that we have identified as ‘outliers’ on the scatter plot. This green-shaded area indicates stocks that have a much higher free cash flow yield than their dividend yields, indicating a high ability to service dividends.

We have outlined a set of stocks below that we have identified as ‘outliers’ on the scatter plot. This green-shaded area indicates stocks that have a much higher free cash flow yield than their dividend yields, indicating a high ability to service dividends.

Let’s take a closer look at some of the stocks which encompass this section of the graph. We will not dive into all of the names within the shaded area, however, several names stand out to us on this graph, including: DOO, WN, PKI, SU, NTR, POW, GWO, and CTC.A. Some of these are names that we have been following at 5i Research. Most of the companies in this shaded area are slower growth, low cyclicality, and mature names that specifically have an income focus.

Let’s take a closer look at some of the stocks which encompass this section of the graph. We will not dive into all of the names within the shaded area, however, several names stand out to us on this graph, including: DOO, WN, PKI, SU, NTR, POW, GWO, and CTC.A. Some of these are names that we have been following at 5i Research. Most of the companies in this shaded area are slower growth, low cyclicality, and mature names that specifically have an income focus.

A brief commentary on recent performance and an overview of what these companies do is below:

BRP Inc. (DOO): DOO is a well-managed consumer company that designs and manufactures powersports vehicles and marine products globally. It has a $7.0 billion market cap, and while its dividend yield is somewhat small at 0.9%, its free cash flow yield of 16% is more than enough to service these dividends. The company has an impressive 15% and 27% five-year sales and earnings CAGR, respectively. It currently trades at a fairly inexpensive valuation of 12X forward earnings, and its profit margins have been stable over the past few years. Including its buyback yield, it currently has a shareholder yield of 8.8%.

Parkland Corp (PKI): PKI is an international fuel distributor and retailer with operations across 25 countries, geared towards providing individuals with essential fuels, convenience items and quality foods. It has a $6.9 billion market cap, and its dividend yield is currently 3.6%. and its free cash flow yield of 18% is more than enough to service these dividends. PKI has a five-year sales and earnings CAGR of 15% and 8%, respectively. It trades at an 11X forward earnings multiple, and its ROE has been climbing recently, now at 12.5%. Most of its free cash flow is directed towards paying down debt, and it has a shareholder yield of 13.5%.

Suncor Energy (SU): SU is a Canadian integrated energy company that specializes in the production of synthetic crude from oil sands and operates through various segments including oil sands, exploration and production, and refining and marketing. It currently has a market cap of $71.9 billion, and its dividend yield is 3.9%. Its free cash flow yield is 11%, more than enough to services its dividend yield. SU has a five-year sales and earnings CAGR of 5% and 14.6%, respectively. It trades at a fair valuation of 10.9X forward earnings, and including buybacks and debt repayments, it has a shareholder yield of 8.4%. This is a name that has been seeing positive momentum recently due to strong earnings results and hitting new milestones in its oil sands production.

Common Theme Among Canadian Stock Outliers

We hope that readers enjoyed this edition of ‘Stock Teasers’ talking about some of the Canadian stock outliers for high free cash flow yields and dividend yields. A common theme among the stocks we highlighted is a low valuation, a high total shareholder yield to match its free cash flow yield, and a history of high sales and earnings growth rates. These are names that are generating a high enough of a free cash flow yield to service their dividends, and also add value to shareholders through other methods. For other editions of our ‘Stock Teasers’, check out our latest blog on ‘This or That? Aritzia (ATZ) or Lululemon (LULU)’.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Comments

Login to post a comment.